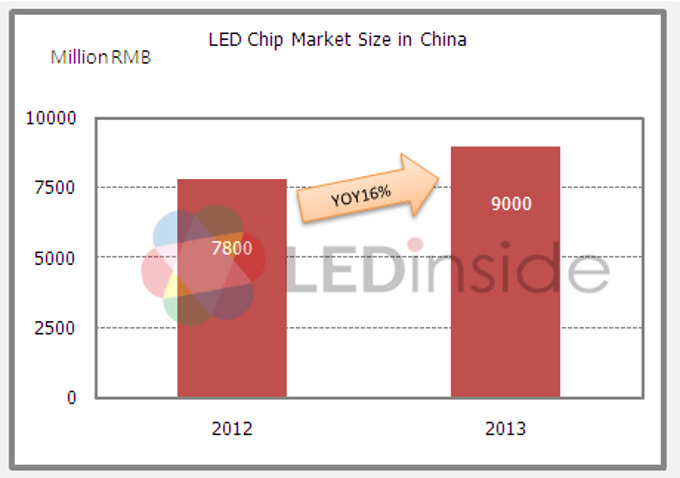

May 15, 2014---LED chip market scale reached RMB 9 billion (US$1.45 billion) in China in 2013, a YoY of 16%, according to the latest “2014 Chinese LED Package Industry Market Report” by LEDinside, a research division of TrendForce.

Spurred by lighting market growth momentum, LED chip market demand further increased resulting in expanded market size. However, continual price drops caused LED chip market revenue growth to lag behind market volume demands. Certain LED chip manufacturers in the market will fail to increase revenue, and profit even after expanding production capacity.

|

|

Fig. 1: LED Chip Market Size in China from 2012-2013 (Source:LEDinside) |

Obvious LED chip price drops, Chinese LED chip manufacturers revenue gradually rebounds

Key players in China’s LED chip supply market include Chinese, Taiwanese and international manufacturers. Manufacturers in the Chinese camp include San’an Opto, Tongfang, HC Semitek and others, while main Taiwanese LED manufacturers include Epistar, FOREPI, Genesis Photonics Inc. (GPI). U.S. manufacturer Bridgelux is the major international LED chip manufacturer in China.

In 2013, mid-power components were in highest demands out of all LED components. Technology advancements enabled Chinese LED chip manufacturers product performance to catch up with Taiwanese manufacturers. An increasing number of LED package manufacturers are gradually accepting Chinese chips. In terms of volume, Chinese LED chip manufacturers currently have an 80 percent market share in China.

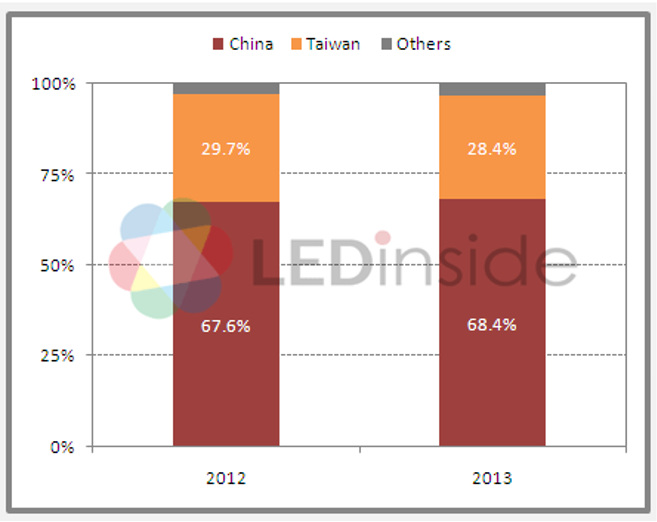

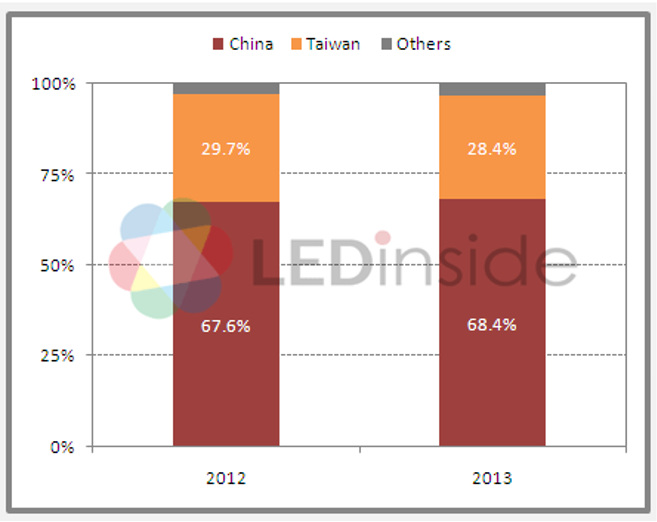

When it comes to pricing, though, there is still some differences between Taiwanese and Chinese LED chip prices. The latter’s LED chip prices are dropping much faster than Taiwanese LED chip manufacturers. From a revenue perspective, China’s manufacturers’ market share was 68.4% in 2013, with total revenue up 17% YoY to RMB 6.2 billion. Taiwanese manufacturers’market share downed slightly to 28.4% in 2013, but total revenue was up 10% to RMB 2.6 million.

|

|

Fig. 2. Chinese LED chip market share by camps. (Source:LEDinside) |

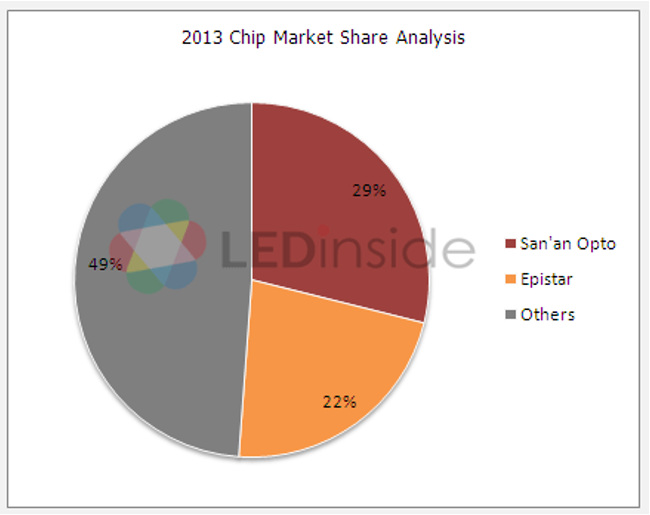

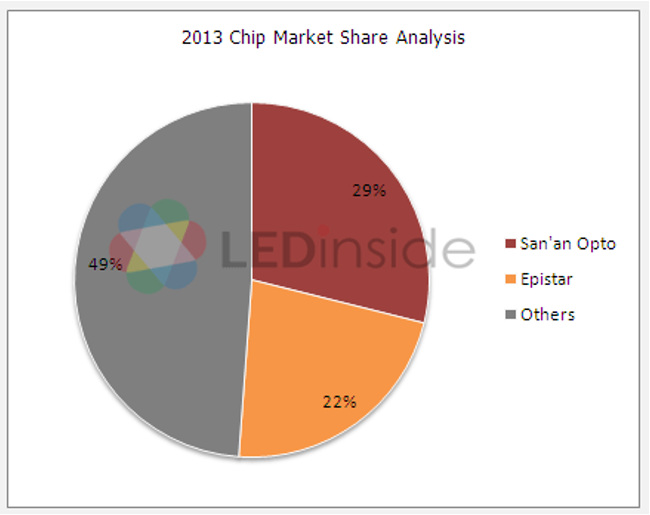

Chinese LED chip market’s industrial concentration continues upward climb with San’an Opto and Epistar making up more than half the market

San’an Opto and Epistar’s combined LED chip market share in China is about 51%, according to data compiled by LEDinside. San’an Opto’s revenue share constitutes more than 40% of Chinese manufacturers’total revenue, while Epistar’s LED chip revenue is a staggering 80% of imported Taiwanese LED chips in China.

Manufacturers continue to encounter difficulties in raising profitability, with many small to mid-sized manufacturers caving under financing pressure. Some small to mid-sized manufacturers have exited the market, due to difficulties in maintaining client relationships, and lack of technological breakthroughs. San’an Opto, a representative of large manufacturers, is currently actively expanding production capacity. Accompanying industry developments, Chinese LED chip market’s industrial concentration will continue to rise.

LED chips are a principal component in LED packaging, and are playing an increasingly important role. Other technical innovations in auxiliary materials including lead frame (EMC/PCT lead frame), phosphor powder (remote phosphor) and adhesives have also significantly impacted LED package industry’s technological developments. In addition, market observations clearly indicate the emergence of Chinese package auxiliary material manufacturers, with rapidly expanding market shares.

|

|

Fig. 3. 2013 Chinese chip market share analysis. (Source:LEDinside) |

Chapter One: Industry Chain Overview

Chapter Two: China LED Industry Overview

Chapter Three: China LED Package Industry Overview

Chapter Four: Major Chinese LED Package Manufacturers

Chapter Five: International LED Enterprises Investment And Business in China

Chapter Six: Important Supporting Industries Related to LED Package Industry

Chapter Seven: Competitiveness of Chinese LED Package Industry

Chapter Eight: New LED Packaging Technology and Hot Topics

Chapter Nine: Conclusions and Investment Suggestions

Published Date: May 31, 2014

Language: English

Format: Electronics

Page: 244

For further details please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@ledinside.com

CN

TW

EN

CN

TW

EN