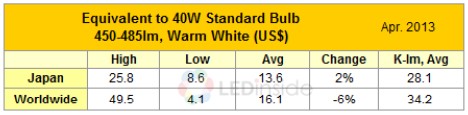

According to LEDinside, a research division of TrendForce, retail prices for LED bulbs worldwide continue to have a downward trend this year for April. Worldwide retail price for 40W equiv. LED bulbs dropped by 5.7%, reaching 16.1 USD. Newly added items in the markets were few. 60W equiv. LED bulb price also experienced a decline, with a worldwide average drop of 1.2%, reaching 23.8 USD. The ASPs in most areas maintained a stable decrease, except for China and Taiwan where the high prices of newly added products lead to an increase.

40W equiv. bulb asp dropped below 10 USD in China

LEDinside expressed that worldwide 40W equiv. LED bulb retail price for April declined by 5.7%, reaching 16.1 USD. Newly added items in the regions were few. Prices in the UKand Germany in April slid by 5.3% and 13.2% respectively, with existing productprices having an extensive downward trend, especially for Osram and Samsung who had an obvious decline in product price. Both UK and Germany did not see any newly added items for this month.

The end of sales promotion period of some products in the Japanese region caused an inflation of 20.2% for the 40W equiv. LED bulb average price. This area temporarily did not have any newly added items. The average price in the US has increased by 3.7%. Existing product price had a slight fluctuation and no new items will be added. Korean prices had a slight decline of 1.6%, with existing product prices remaining the same, while the price drop was mainly due to the growth in exchange rate.

40W equiv bulb price dropped by 9% in China, reaching 9.8 USD, remained the lowest in the current surveyed regions. This is mainly due to sales promotion on part of product, led a sufficient drop in price. With the prices of newly added items in the Taiwanese region leading to an average price drop, the ASP for April slid by 16.7% with existing product prices maintaining stable.

Source:LEDinside

60W equiv. bulb price had a clear decline in the European market

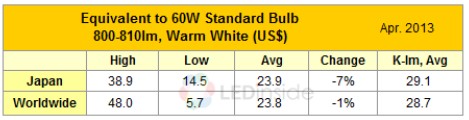

There was a drop of 1.2% in 60W equiv. LED bulb price, reaching 23.8 USD. The ASPs in most areas maintained a stable decrease, except for China and Taiwan where the high prices of newly added products lead to increase.

Prices in the Japanese region in April declined by 7.1%, reaching 23.9 USD. Existing product price had a slight fluctuation, and the price decline was mostly caused by exchange rate growth. Korean region prices had a slight slide of 1.6%, with existing product prices experiencing no change, while exchange rate growth causing the prices to drop.

The US price declined by 0.7%. with a slight fluctuation in existing product price. Newly added items for this month were many. UK and Germany had a drop in price of 4.8% and 7.3% respectively. Existing product prices in Germany had a large general large reduction, with newly added items being few in these two regions.

Chinese and Taiwanese regions had a price rise of 11.6% and 13.4% for 60W equiv. bulbs. Existing product prices for these two regions remained stable, while high prices of newly added items leading to an average price increase.

Source:LEDinside

European prices consistently declined, and the competition with Korean manufacturers intensified

LEDinside observed that in April, Osram and Samsung bulb products had a clear price drop in the European region. After Samsung’s 7.5W LED bulb price broke 10 EU, Osram also had a large drop in retail price, whose 8W LED bulb with a luminous flux of 470lm that are used to replace 40W incandescent light bulbs had a retail price of 9.95 EU in the German region for April.

LEDinside believes that Osram’s move to drop the price shows its intent and determination for seizing the European lighting consumer market. Also at the same time, Korean manufacturers such as , Samsung continues to use the price-war strategy, repeatedly dropping prices and actively gaining the European market share. With the European market competition speedily heating up, and with product prices continuing to decline, it can be observed that the implemetation of ban on incandescent lamp and the economic recovery after the Eruopean debt crisis has brought growing positive impact on the LED bulb market, and LED bulb penetration rate is expected to increase quickly.