Mid-power LED shortages eased in 3Q13, due to increasing LED suppliers, according to LEDinside, an LED research division of international research organization TrendForce. High-power LED prices dropped in 3Q as outdoor lighting demands and construction bidding projects fell below market expectations in 2Q, and impacts from advances of mid-power LEDs , such as 5630 package (PKG) and 3030 PKG, threat the high-powered LED market share. Both uncertainty surrounding China’s new energy-saving appliance subsidies and high inventory levels in distribution channels have caused the LED price for TV application to drop. However, LED for mobile applications have a positive 3Q outlook due to increasing smartphone shipments and introduction of two in one package.

Prices slightly fall 3-6% in 3Q13 as LED demand for smartphone applications rises

Smartphone shipments have soared. Driven by on average bigger smartphone panel sizes and higher resolutions, LED usage volume for smartphone applications have grown. By taking into consideration energy-saving and slimmer designs, LED manufacturers released 0.6 mm side view LED (two-in-one, side view package type), with a voltage lower than 6V, and average brightness of 15 lm. A design that is not only energy efficient, but avoids adding any burdens to mechanical design. Average Selling Price (ASP) for 0.6t LED dropped by 6% to US$ 0.15.

Uncertain new Chinese energy-saving subsidies causes LED ASP for direct-type TV to plunge 8%

Distributors were conservative in their inventory stockpile for China’s National Day Week due to China’s uncertain new energy-saving subsidies. In addition, distributors have 1-2 months worth of inventory. These factors caused LED prices for TV application to slide by 6%-9%. The 7020 PKG (single chip) and 7020 PKG (two-in-one) ASP plunged the most this quarter by 9% because of improved yield rates and increasing LED volume usage. Supplies of 4020 PKG and 7030 PKG remained stable and prices dropped by 6% in 3Q13. Affected by the end of China’s energy-saving home appliance subsidy program, TV manufacturers have shifted their focus in the direct-type LED TV segment from energy-efficiency to costs. Starting from 3Q, direct-type LED TVs have used LEDs with high current drives above 400mA as LED backlight sources. LED asp for direct-type TV fell by 8% in 3Q13.

Prices of 5630 PKG mid-power LED downs by 1.7% in July as shortage eases

Overall, mid-power LED shortages have eased in July, and agents have sufficient inventory supply causing prices to fall slightly by 1.7%. Samsung’s second generation 5630 PKG prices continued to show a minor decrease this month, while prices for first generation 5630 PKG remained stable. The prices of other 5630 LEDs remained flat, but there is still room for price cuts.

Global sales of backlight products were lower than expected during second half of 2013. Annual shipment for notebook and monitor applications showed decline, while corresponding LED products, for instance 0.8t side view PKG and 4014 PKG ASP fell by 5%-8% during 3Q. Price drops for 3020/3014 PKG were limited to 1% because of its longer product cycle and maturation. LED prices for TV application declined by 6-9%. The price fall was aggravated by TV manufacturers lowered 2013 shipment volumes, due to the termination of Chinese government's subsidies. Prices for mid/high power LEDs began to decline this quarter. With the exception of warm white LED products, other LED products no longer have supply shortages. Under the pressure of releasing 2Q13 financial reports in June, some manufacturers have lowered prices. However, manufacturers’ new products are still in the sampling, promotion phase, or in the process of replacing old products. Consequently, obvious price competitions are expected to occur in 3Q13.

Source: LEDinside

【Lighting Market Trend – Residential lighting market trend】

According to LEDinside, observations from the 2013 regional residential lighting market development indicated the Chinese market proportion will increase from 19% in 2012 to 24%, and become the fastest-growing regional market. In terms of the European market, the implementation of comprehensive ban of incandescent lamps and the economic recovery after the European debt crisis gradually has a positive impact on LED light bulb market, and market penetration rate is expected to increase.

In view of the users and using habits of LED lighting products, LED lighting is more energy efficient compared to conventional lighting. Hence, LED lighting penetration rate will increase more quickly in commercial lighting, industrial lighting and outdoor lighting, because energy-saving demand in those applications is higher, and all users are professional.

Residential LED Lighting Market in 2012

Source: LEDinside

Residential lighting is mainly targeted for the general consumers, except that their awareness of the LED lighting is not high, they are more sensitive to the initial investment cost. Therefore, LED lighting penetration rate in residential lighting relatively lags behind other application areas.

In contrast to LED commercial lighting, LED residential lighting is characterized by diverse consumers that are more sensitive to prices; demand for lower power products; and low gross profits for lighting manufacturers. Therefore, as LED lighting becomes popular, manufacturers need to carefully develop each market segment and consumer habits, and stringently control costs and product quality. Especially, in the beginning when prices decline rapidly and consumer habits are constantly changing, manufacturers can easily miss out opportunities to quickly establish sales channels and product popularity if they do not use low price strategies to enter the market.

【Automotive Lighting Market Development Trend- Trends in the LED Rear Combination Lamp (RCL) Market】

RCL composes of tail lights, brake lights and direction lights. Regulations require high brightness for brake and direction lights, while tail lights require lower brightness.

Taking into consideration factors such as cost and aesthetics, the majority of RCL design is composed of conventional lamps and LEDs. Market share of the design with conventional amp and LEDs gradually decreased in 2013, while shares of RCL using solely LEDs increased.

2011 LED For RCL Application (Volume)

Source: LEDinside

【LED Backlight Market Development Trend- Analysis of Second Generation LED TV’s Added Value And New LED Materials】

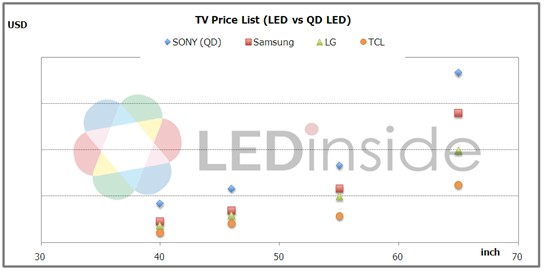

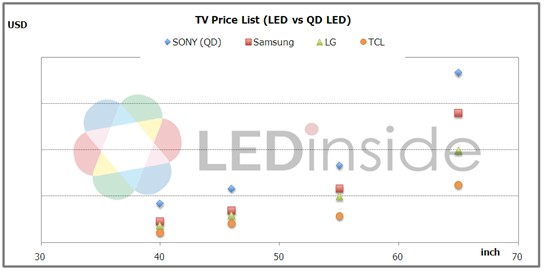

Quantum dot became an important new LED technology that display and package manufacturers are focused on in 2H13 and 1H14 to create market segmentation, and improve color saturation by using either QD LED tubes or optical films. Under the pretext of competitive pricing in display applications, it’s important for companies to lower product costs. For example, manufacturers should reduce the costs of 4K2K TV to 1.3 times or below the price of same sized HD TV, and control the price of QD TVs at 1.5 times or below of HD TV. This measure can greatly increase sales performance.

TV Price List (LED TV v.s. QD TV)

Source: LEDinside

LEDinside 3Q13 Silver+ Member Report Outline

[LED lighting market development – Outline]

Residential Lighting Market Outlook

-

Definition of Residential Lighting

-

Presentation of Residential Lighting

-

Luminaries Requirements for Residential Lighting

-

Lighting Scenarios Analysis

-

Global LED Residential Lighting Market Dynamics – Regional Proportion of Production Volume

North America

-

Market Overview - LED Penetration Rate in North America, Observation of North American Residential Lighting Market from New Home Sales

-

The Bulb Prices in U.S. Show The Fluctuation Trend, And Have Reached A Sweet Point

-

Policies - Energy Star, Title 24

-

Manufacturers’ Trends - 40W / 60W LED Bulb Pricing Strategy

Europe

-

Market Overview - European Residential Lighting Market Analysis, European Incandescent Lamps Ban Policy Influence—Chinese LED Lamps Exports To Europe, and Development of European LED Manufacturers

-

Policies - European LED Residential Lighting Certification Standards, EU Energy Directive 20-20-20 Goals & 2011 Energy Efficiency Plan

-

Manufacturers’ Trends – IKEA, Philips, Osram, Zumtobel

Japan

-

LED Light Bulb - LED Bulb Shipment in 2012 and 2013, Analysis Of LED Bulb Price Trends And Market Share

-

LED Bulb Pricing Strategy - 40W/ 60W Equiv. LED Lamp Pricing Strategy

-

Lighting Manufacturer’s Future Strategy - Three Major Strategies of Lighting Manufacturers’ Development (Panasonic, Toshiba, Sharp, Toshiba, Hitachi, Iris Ohyama)

China

-

Market Overview - Analysis of China’s Residential LED Lighting Market Scale And Estimations Of LED Penetration Rates, In 2013, Fiscal Subsidies Were Extended To 30 Million LED luminaires Including Residential Lighting Products, Obstacles of LED Residential Lighting Penetration Rate.

-

Pricing Strategy - China’s 40W / 60W Equiv. LED Lamp Price Trend, Survey of China’s Main Residential Luminaire Prices, Observations of Chinese Lighting Manufacturers’ LED Lamp Pricing Strategies

-

Manufacturers’ Trends - Three Main Groups in China’s Residential Lighting Market (International Brands, Domestic Conventional Lighting Brands, and Emerging Domestic LED Lighting Brands.)

-

Major Manufacturers – Opple, MLS, IKEA China

Emerging Markets: Taiwan / Thailand

Taiwan

-

Market Overview - Analysis And Forecast Of Taiwan’s 2012-2013 LED Bulb Shipment Volume, Top Five Ranking Taiwan LED Bulb Shipment Manufacturers, Is there Chance for LED Bulb to be Included in Grant Projects in Taiwan?

-

Pricing Strategy - 40W / 60W Equiv. LED Lamp Price Trend, Taiwanese Lighting Manufacturers’ LED Lamp Pricing Strategies

Thailand

-

Thailand Formulates a Five-year Power Development Plan to Promote LED Lighting

Appendix: Bulb Specification In Major Regions

USA

Europe

Japan

China

Taiwan (LED Packaging Manufacturer’s Supply Chain)

【Automotive Lighting Market Development Trend-Outline】

Car Market Demand

-

2Q13 Regional Market Performance

-

Highlight In Specific Markets

RCL Development History And Driving Forces

LED Development In RCL Application

-

RCL Product Development

-

Differences Between Direction Type And Plane type Design

-

LED Development Trend in Power and Usage Volume

Trend In Penetration Rate of Conventional Lamps And LED Lamps in The RCL Market

【LED Backlight Market Development Trend- Outline】

Analysis of Second Generation LED TV’s Added Value And New LED Materials

4K2K TV

-

Can 4K2K TV Stimulate LED Backlight Market Demand?

-

LED Usage Volume For 40”~84” TV

-

Market Opportunity And Challenge Analysis

QD TV

-

QDTV Owns Higher Color Saturation

-

Current Quantum Dot Technology Solutions

-

TV Price List ( LED TV v.s. QD TV)

-

QD TV Strength and Weakness

EMC

-

Lead Frame Solutions For 1W And Above LED In Backlight Application

-

Comparison Between LED Lead Frame Material And Characteristics (PPA、PCT、EMC)

-

Lead Frames In Response To LED efficiency In Backlight Application (PPA、PCT、EMC)

If you would like to know more details , please contact:

|

Taipei:

|

|

ShenZhen:

|

Shanghai:

|

Joanne Wu

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |

Kirstin Wu

kirstinwu@trendforce.com

+886-2-7702-6888 ext. 630 |

Sara Fan

sarafan@sz.dramexchange.com

+86-755-8283-8931 |

Allen Li

AllenLi@trendforce.com

+86-21-6439-9830 ext. 608 |