China’s strategic “One belt, one road” policy has sparked local manufacturers interests of exporting products abroad, but most are afraid to take action. Statistics from different research organizations have varied widely. Many research organizations only speak about potential opportunities at investor conferences, few talk about potential investment risks.

LEDinside’s editorial team compiled data from China’s customs (General Administration of Customs People's Republic of China) and other research organization reports to present an overview of market conditions of certain popular oversea markets. The following market evaluations are for reference purposes.

LED manufacturers interested in certain oversea markets should conduct thorough research, or consider cooperating with LEDinside’s analysts to find out whether these are markets suitable for future investments.

Power hungry Egypt presents huge market potential for LED manufacturers

Egypt is Africa’s third largest economy, and the largest consumer market in Middle East and Africa. It is also one of the fastest growing emerging markets and economies. Egypt has signed free trade agreements with Middle East and other African countries indicating foreign investors in Egypt will also have access to neighboring regional markets. Potentially, the Middle East and African region combined has billions of consumers. Additionally, Egypt has a large volume of cheap labors.

|

|

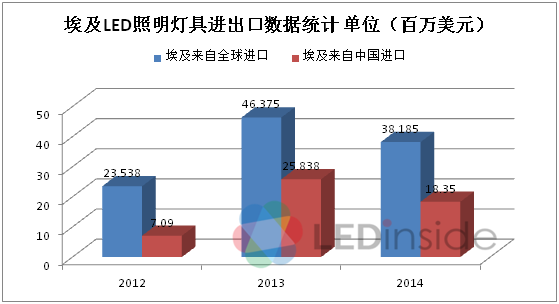

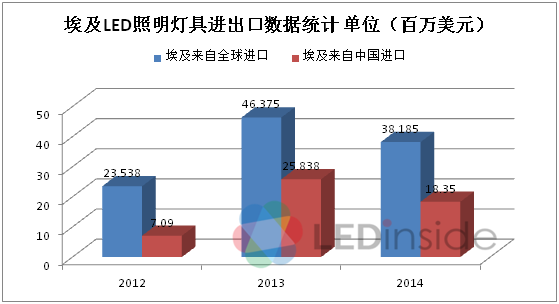

LED luminaires imports in Egypt. The blue bar indicates LED luminaire products Egypt has imported from global suppliers, and the red bar indicates the volume of products imported from Chinese manufacturers. All units in millions of US$ along the y-axis. Imports from 2012 to 2014 indicated by x-axis. (Source: General Administration of Customs People's Republic of China (GACC), graph designed by LEDinside) |

In regards to market size, the Egyptian government plans to save up RMB 20 billion (US $3.14 billion) in energy subsidies by 2020. The proposed subsidies are used to lower costs, and to make energy facilities more energy efficient.

Lighting’s energy consumption amounts for 25% of the country’s energy consumption, while household and commercial lighting consumption makes up the majority 73%s. Hence, the country hopes to turn to professional smart lighting solutions to replace traditional lighting applications and reduce energy.

Egypt plans to roll out a massive lighting upgrade after 2020, and use energy efficient products to replace traditional lighting. Government buildings, residential lighting and other regions and governorates outdoor lighting will all be replaced with LEDs. The country has procured 250 million LED bulbs for residential lighting applications. In addition, the government has promoted other LED lighting projects.

The country’s Ministry of Electricity Energy will be issuing 1.7 million LED bulbs within the next four months, according a report from The Cairo Post in June this year. These bulbs will be distributed to nine provinces in Egypt, and believed to be one of the solutions to the country’s energy crisis issue.

Severe power shortages have become frequent in the country in the aftermath of the Egyptian Revolution in 2011, and locals are becoming accustomed to two to three blackouts per day.

Ministry of Electricity Energy is recommending public to use LED bulbs instead, and keep air condition temperatures above 25°C. At the same time it has asked public to refrain from operating multiple electronic equipment at the same time to help the country conserve energy.

Egyptian government has promised it will be providing a part of these subsidies. Since they need to reduce their costs, benefits of the subsidies will be optimized.

Additionally, manufacturers that establish factories in Egypt will be able to tap into a market with potentially 1.6 billion consumers, since the country has signed tariff free agreements with countries in Europe, Middle East and Africa.

UAE rebounding real estate market fueling lighitng market demands

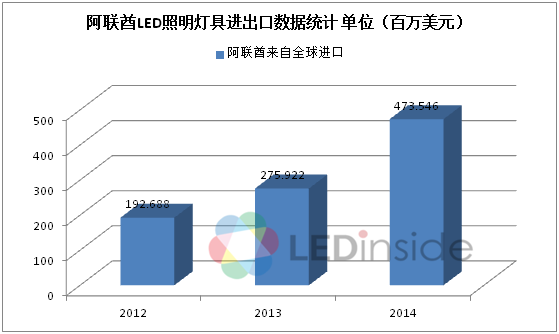

UAE’s architectural industry is recovering after the disastrous real estate crash in 2008 that left the industry close to the brink of a crash. The reviving real estate market has created many new construction projects leading to a prospering lighting market. Additionally, the UAE population has increased steadily and is spurring rapid urbanization. These factors are driving the Middle East country to value environmental friendly products to control carbon emissions and energy conservation.

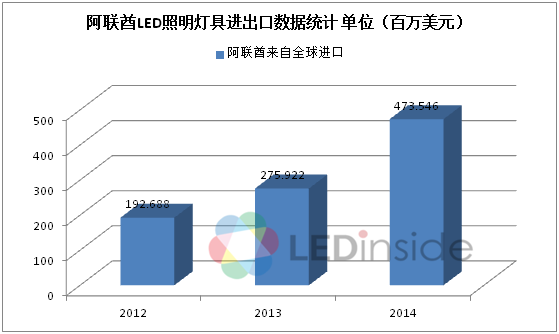

In 2012, the UAE LED luminaire market value reached an estimated US $46 million to US$ 54 million, roughly equivalent to revenue generated from selling 1 million to 1.2 million luminaires, according to statistics compiled by LEDinside. In the following year, the LED lighting market share climbed up to about US $60 million to US $68 million. By 2014, the UAE LED lighting market is estimated to increase 23% to reach about US $ 78 million to US $82 million.

International LED manufacturers Philips, GE and Osram have maintained their leading market positions in the country with a combined market share of more than 60% in 2014.

The total value of LED lighting products exported to UAE reached US $70.92 million during first quarter of 2015, and amounted to about 1.9% of China’s total export value. The top three LED lighting products in the local market include ceiling lights, LED panel lights and LED downlights, which market shares are respectively 23.8%, 19.7% and 17.6%.

|

|

UAE LED imports from global suppliers. All units in millions of US$ along the y-axis. Imports from 2012 to 2014 indicated by x-axis. (Source: General Administration of Customs People's Republic of China (GACC), graph designed by LEDinside) |

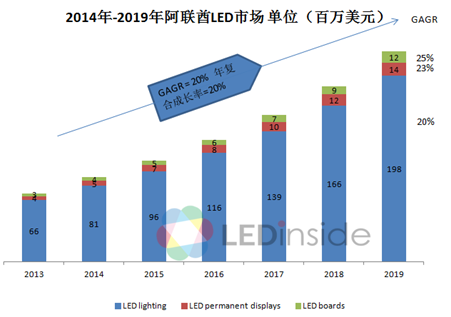

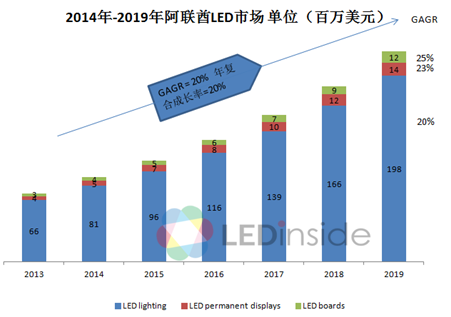

The UAE LED market is showing strong growth, and its market value is estimated to increase US $224 million by 2019, and projected to increase at a Compound Annual Growth Rate (CAGR) of 20% from 2014 to 2019.

|

|

Projected LED market growth in UAE market from 2013 to 2019. All units in millions of US$. (Source: General Administration of Customs People's Republic of China (GACC), graph designed by LEDinside) |

Additionally, Dubai will be hosting the World Expo in 2020, which will spur LED industry growth and create huge market demand. Under China’s “One belt, one road” policy, UAE and China’s ties have also become much closer, and are forming more partnerships in infrastructure construction projects.

Policy wise the UAE announced its new energy saving lighting product regulations, will ban the sales of less energy efficient light bulbs and promotes energy efficient, safe and high quality bulbs. The new regulations initiated since July 1, 2014 is focused on phasing out less efficient bulbs, which also regulates the recycle and installation of the bulbs.

The UAE is leading the Middle East in lighting standards and related regulations. The Emirates Authority for Standardization and Metrology (ESMA) has banned the sales of incandescent bulbs in UAE since Dec. 31, 2014.

UAE ESMA product standards:

-

The UAE lighting product has to meet certification and registration requirements.

-

The lighting product parameters has to meet all regulations for electric safety, energy efficiency, performance and safe disposal.

-

All lighting products must have energy labels on its package, which show energy efficiency levels and other details.

-

Lighting products that do not meet these regulations cannot be imported into the UAE market.

Indian government policies overhauling outdated inefficient lighting spurs massive LED demands

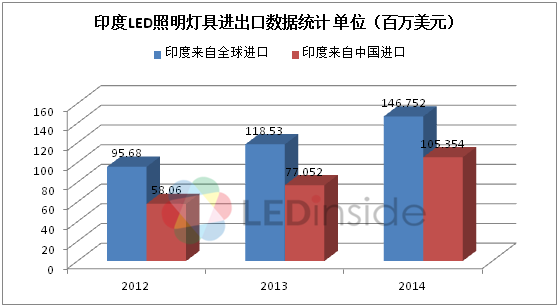

India is the world’s second most populated country, with huge market size and economic growth. The Indian government started to promote carbon emission reduction policies in October 2014, encouraging public to use LED bulbs to replace the current 750 million incandescent bulbs on the market.

The Indian manufacturing industry is not particularly strong, hence most of the LED products on the market are mostly products with lower technical levels. In comparison to the European and North American market that have higher entry levels, Chinese manufacturers products exported to the Indian market can potentially be labelled as high-end products.

However, competition in the Indian market is very intense. International LED manufacturers from U.S., Germany, Japan and South Korea are also contending for market shares.

Currently, more than 300 million people in India live off the electricity grid. Local manufacturers lack core LED technologies, which has made the country highly reliant on LED luminaire imports. Compared to traditional luminaires, LED bulbs still have a much higher price tag.

Most of India’s LED products are applied in outdoor lighting products, but civilian market demands have soared following economic developments, increased power coverage, and stabler power supplies.

|

|

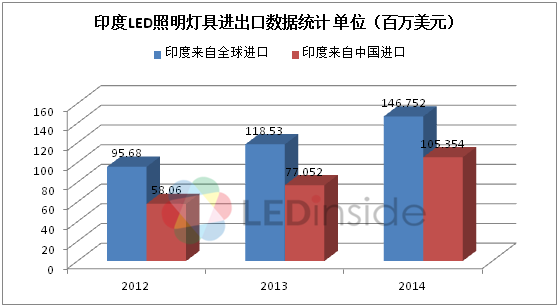

LED luminaires imports in India. The blue bar indicates LED luminaire products India has imported from global suppliers, and the red bar indicates the volume of products imported from Chinese manufacturers. All units in millions of US$ along the y-axis. Imports from 2012 to 2014 indicated by x-axis. (Source: General Administration of Customs People's Republic of China (GACC), graph designed by LEDinside) |

In 2012, the Indian LED lighting market value was estimated to value US $100 million, and consisted a very small 3-5% market share of the country’s total general lighting market. In the residential lighting market, most newly constructed complexes used LEDs, while existing CFL users’ willingness to switch to LEDs has been relatively low.

Government projects is the main LED lighting market growth driver in India, and amounts for nearly 51% of orders. On the other hand, LED downlights, industrial lighting and other none residential lighting products have also introduced LED light sources.

Countries promotion of LED lighting has strengthened in 2015, India especially has been striving to make bulbs more widespread.

India’s Prime Minister Narendra Modi is promoting the installation of energy efficient LED lights in commercial buildings, streetlights and average households. Modi has even initiated the LED residential and streetlight replacement project named “Prakesh Path.”

In early 2015, the country’s Press Information Bureau (PIB) announced the Bureau of Energy Efficiency (BEE), an arm of the nation’s Ministry of Power, will be partnering up with Energy Efficiency Services Limited (EESL) to roll out a LED bulb government tender and commercial model roadmap.

More than 302 government agencies have joined the project, and over 186 cities have joined the household lighting and appliance LED lighting upgrade and replacement sector of the project.

In the public lighting market sector, India is preparing to swap all conventional residential lighting and streetlight products to LEDs in more than 100 cities before March 2019. Presently, the country has more than 770 million bulbs, and some 35 million streetlight bulbs.

It is believed government projects will make Indian LED market even more attractive to investors. Catalyzed by cities rapid urbanization and industrialization developments, the LED luminaire market value is estimated to reach US $1 billion by 2020. The LED streetlight market value is projected to reach US $41 million by 2015 to 2020.

Additionally, to reduce its LED industry reliance on imports, the Indian government has issued two large semiconductor subsidies valuing US $2.5 billion, which encompasses De Core Science and Technologies fabs in Gujurat state.

According to market insiders, the majority of LED chips in the country are supplied by Philips and Nichia. Philips market share in the Iocal lighting market reached 65%. Global manufacturers including Cree, Nichia, Samsung and Osram are also leading blue LED chip market developments in the country. Although, Taiwanese LED manufacturers Epistar and Everlight products have emerged in the Indian market, their overall market share remains low.

It is foreseeable that Chinese manufacturers involvement in the Indian market will increase, following the rise of Chinese LED chip manufacturers and technology advancements that are making their products cost/performance (C/P) ratio increasingly evident.

Everlight’s use of Chinese LED chips in its products being sold in the Indian market proves this trend, and they might acquire larger market share in the future.

Indian government plicies supporting LED industry developments

In terms of policies to encourage and promote LED industry developments, the Indian government has announced two different policies. The first is including LED chip factories under its Modified Special Incentive Package Scheme(M-SIPS) that provides cash grant up to 20% of the cost of project to companies that set up semiconductor fab in India subject to a minimum initial investment of approximately US$ 50 million. The incentive is applicable to both local and foreign investors with the aim of encouraging manufacturers to establish semiconductor factories in the country.

Another government policy being rolled out is supplying 3.7 million households living in poverty with residential LED light bulbs. Starting in 2015, the Indian government has sold two LED bulbs at a subsidized price of INR 10 (US $0.15) each to households.

The Indian government is selling the LED bulbs against the market average sales price of INR 300 to 400. The country’s Energy Efficiency Services Limited (EESL) has offered a subsidy of INR 95 to INR 125 per bulb.

Last of the government incentives is LEDs under the Preferred Market Access Policy of Government of India, under which the Government of India shall provide 50% of tendered quantity of LED based products to companies, who do at least 50% value addition through manufacturing in India. However, there is no preference on the tender price or specifications for the tender. This enables companies manufacturing LEDs within India to gain access to local markets.

(Author: Skavy Chen, Editor, LEDinside China http:// Translator: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN