Recently, Aixtron announced that it has been supplying the AIX G5+ C MOCVD system for Micro LED manufacturing to a tier-one US LED supplier, though Aixtron did not disclose the identity of the US company and further details of the transaction.

One of the key parts of Micro LED manufacturing is mass transfer. Achieving Micro LED mass transfer requires significantly more stringent wavelength uniformity and defect density parameters during the epitaxy process, compared to conventional LEDs. For Micro LED mass production to be viable, manufacturers must therefore strive for continued innovation in the MOCVD equipment required for epitaxy.

In an official press release issued by Aixtron, the company states the following:

The AIX G5+ C system from AIXTRON uses in this regards wafer-level control (based on Auto-Feed Forward) of the film surface temperature during the epitaxial process in combination with Ultraviolet (UV) pyrometry. This warrants a very accurate control of the Indium incorporation into the Multi-Quantum wells (MQW), which will ultimately define the wavelength consistency among all produced wafers. A cassette-to-cassette transfer module coupled with in-situ cleaning complement then the technical solution to ensure that no particle will contaminate the films during handling or the epitaxy process.

In addition, Aixtron’s MOCVD system is able to keep the wafer’s defect density within 0.10/cm2 while maintaining a ≥4 nm wavelength uniformity, resulting in massively improved epitaxial yield performance.

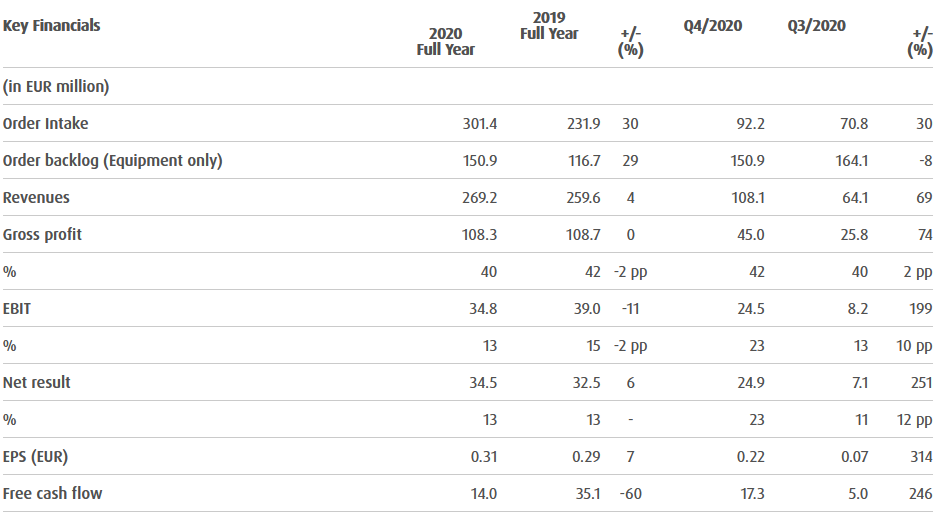

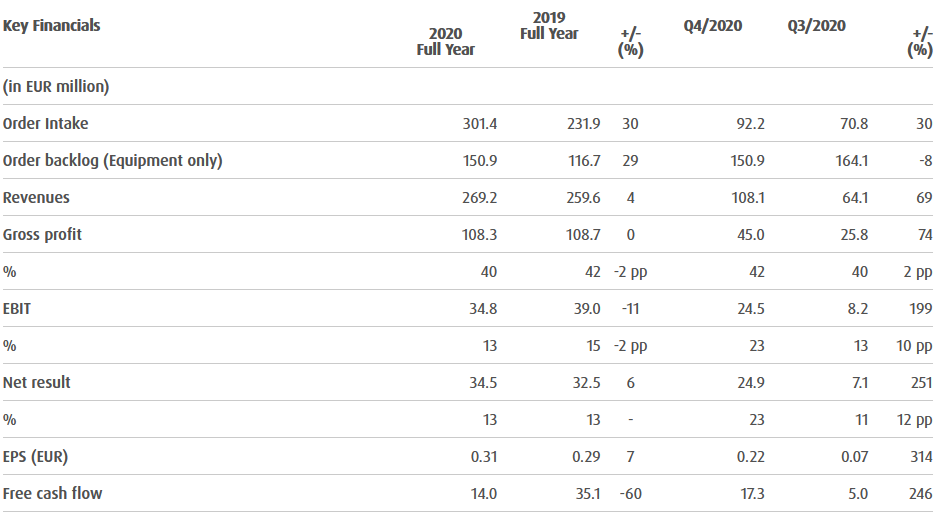

As demand for high-end technologies, such as Micro LED, in the LED market remained in an upward trajectory in 2020, Aixtron’s financial performance was in line with expectations, coming to a revenue of 269 RMB (a 4% increase YoY), gross profit of 108 RMB (unchanged from 2019), and FCF of €14 million (a 60% decrease YoY).

Aixtron’s new orders for the year totaled €301.4 million, a 30% increase YoY. More specifically, Aixtron saw the highest number of orders during 4Q20 compared to the other three quarters. Aixtron’s newly added orders in 4Q20 reached €92.2 million, a 30% increase QoQ and the highest single-quarter sales since 2011.

With regards to regional businesses, Asia accounted for 73% of Aixtron’s total MOCVD sales for 2020 (compared to 68% in 2019), while Europe and the Americas each accounted for 15% and 12%, respectively, (compared to 16% for each of these two regions in 2019).

Looking ahead to FY 2021, Aixtron is expected to see an influx of new orders, likely totaling about €340-380 million, and a corresponding increase in its revenue and profit. Aixtron’s gross profit margin for 2021 is projected to reach about 40%.

LEDinside’s latest investigations indicate that PlayNitride and Konka successively purchased Aixtron’s AIX G5+ C systems within the past two years in order to accelerate their Micro LED R&D and manufacturing efforts. As previously mentioned, orders for Aixtron equipment have been growing nonstop at the moment.

(Author: LEDinside Janice; Image: unsplash)