Engineered with the latest Mini

LED technology, the new iPad Pro was finally unveiled earlier this year, suggesting that Apple, the consumer electronics trendsetter, has again applied an innovative technology to its products and that the year 2021 marks the start of Mini LED commercialization. TrendForce forecasts that the value of Mini LED chips in backlight TV application alone will reach US$270 million in 2021.

(Image source: Apple)

(Image source: Apple)

Mini LED commercialization puts the Taiwanese optoelectronics industry—which has suffered from overcapacity and fierce price competition over the past few years—back in the spotlight thanks to its early development and mass production of Mini LEDs.

Why can Mini LED revolutionize the display industry? Let’s look at its definition first. As its name suggest, Mini LED chips are miniatures of traditional LEDs, of which the size ranges between that of traditional LEDs and that of the next-generation Micro LEDs. Currently, chips with a size of 75–500μm are known as Mini LED chips.

Tablets, TVs, and Notebooks Offer Business Opportunities for Mini LED Supply Chain

At present, the largest commercialization market of Mini LEDs is the same as that of traditional LEDs, that is, the backlight market. Compared with LED backlights, Mini LED backlights largely enhances display contrast and resolution mainly because of the local dimming technology, making Mini LED a new favorite of Apple and other companies.

For example, the 12.9-inch iPad Pro launched earlier this year comes with the Liquid Retina XDR display sustaining 1000 nits of brightness across the full screen. Unlike traditional LED backlighting where light is created from the edges of the monitor, Mini LED backlighting allows the light to be evenly distributed on the entire back of the monitor. The model’s backlight module comprises more than 10,000 special Mini LEDs along with 2500+ dimming zones, enabling the iPad Pro to present deep blacks and bright images and achieve a phenomenal 1-million-to-1 contrast ratio.

In addition to the Mini LED fever among leading brands of consumer electronics triggered by the new iPad launch, Mini LED TVs aiming at high-end market is another key application to the increase in Mini LED penetration. Players including Samsung, LG, TCL, and Xiaomi have launched Mini LED TVs providing stunning visual experiences with high brightness and contrast, aiming to compete against the costly OLED TVs.

▲ The Neo QLED TV launched by Samsung in 2021 adopts Mini LED technology

(Image source: Samsung)

Further, major computer technology companies have actively entered the new display technology competition. Acer and MSI both launched new Mini-LED-backlit notebooks boasting a 4K Mini LED monitor, high contrast, and high brightness, targeting the gaming market. Compared with Mini LED TVs, Mini LED notebooks are relatively rare. However, the likelihood of Apple adopting Mini LED backlighting for its new MacBook Pro can lead to a much-anticipated boom in notebooks using Mini LED backlights.

▲ The Acer-developed gaming notebook Predator Helios 500 features a Mini LED monitor

(Image source: Acer)

List Unveiled: Taiwanese Businesses Become Major Mini LED Suppliers

Mini LED commercialization will surely open up new opportunities for Taiwanese businesses. Because of early market entry, Taiwanese manufacturers have once more—after a long time—entered the Mini LED supply chain for the next-generation 13-inch iPad Pro products. Specifically, the supplier list comprises Mini LED testing and sorting system providers FitTech, Saultech, and Youngtek and Mini LED chip producer Ennostar, along with SMT service providers TSMT and Yenrich, PCB suppliers Zhen Ding and Tripod, driver IC manufacturers Parade, Novatek, and Macroblock, as well as light source module distributors Radiant and GIS.

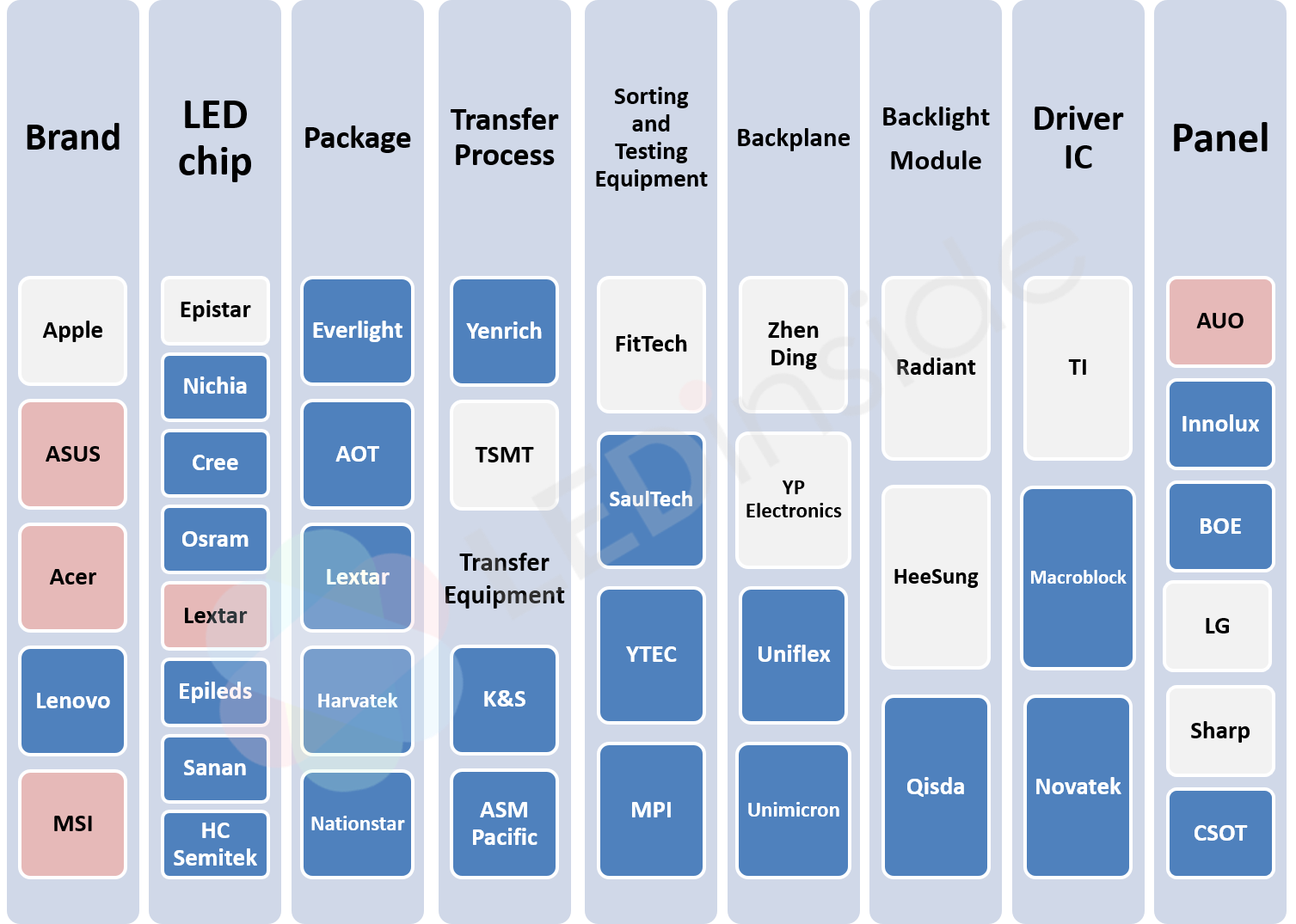

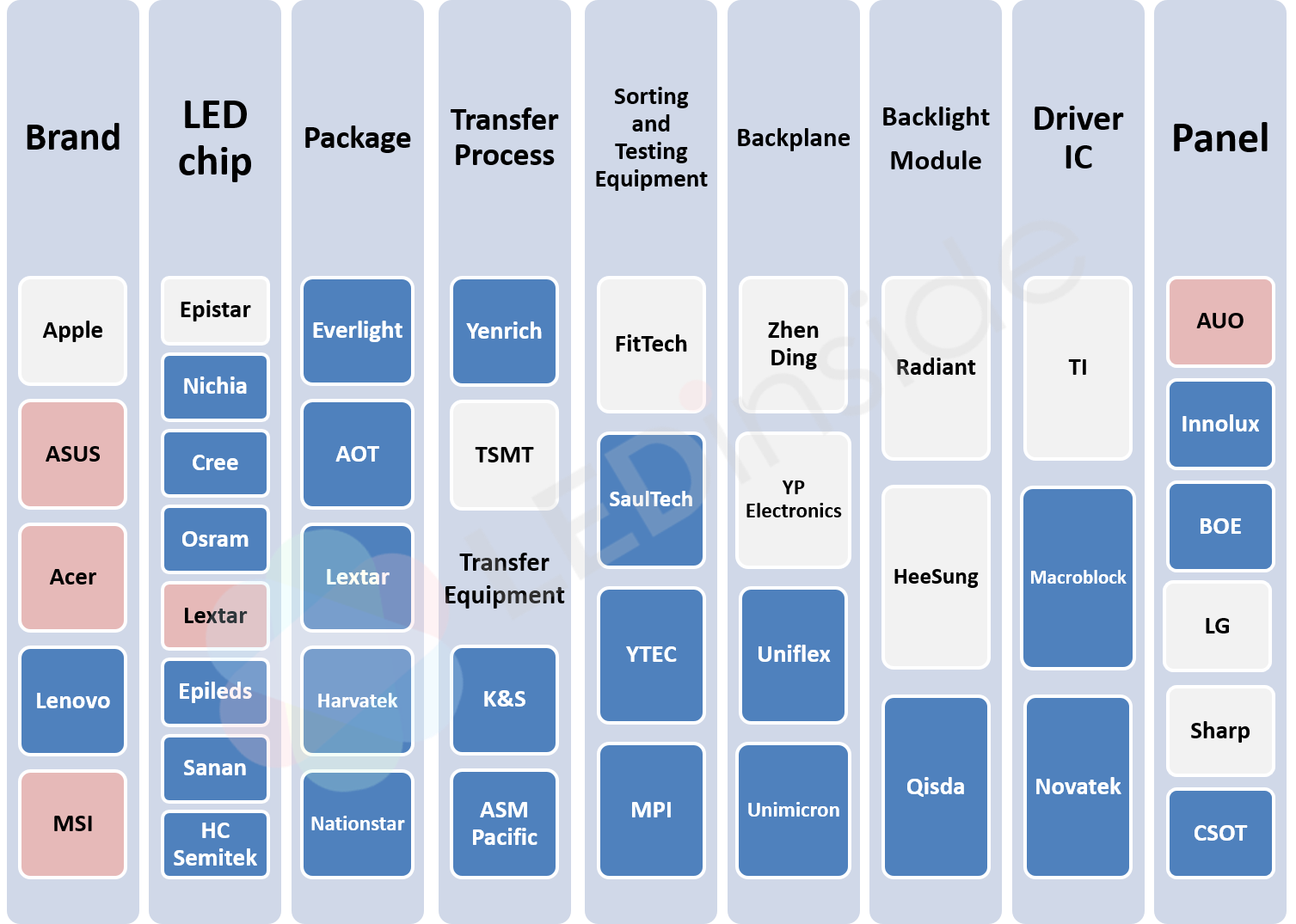

▲ The Mini LED backlighting supply chain

▲ The Mini LED backlighting supply chain

(Image source: TrendForce)

The Mini LED supply chain in Taiwan is complete, including suppliers of LED chips (Ennostar), packaging services (Everlight, AOT, Lextar, and Harvatek), process equipment (Yenrich, TSMT, and GIS), testing and sorting systems (FitTech, Youngtek, and MPI), backlight modules (Radiant), and driver ICs (Macroblock and Novatek).Additionally, leading panel players, namely AUO and Innolux, are striving for research and development of relevant products.

(This article is reposted by TechNews)