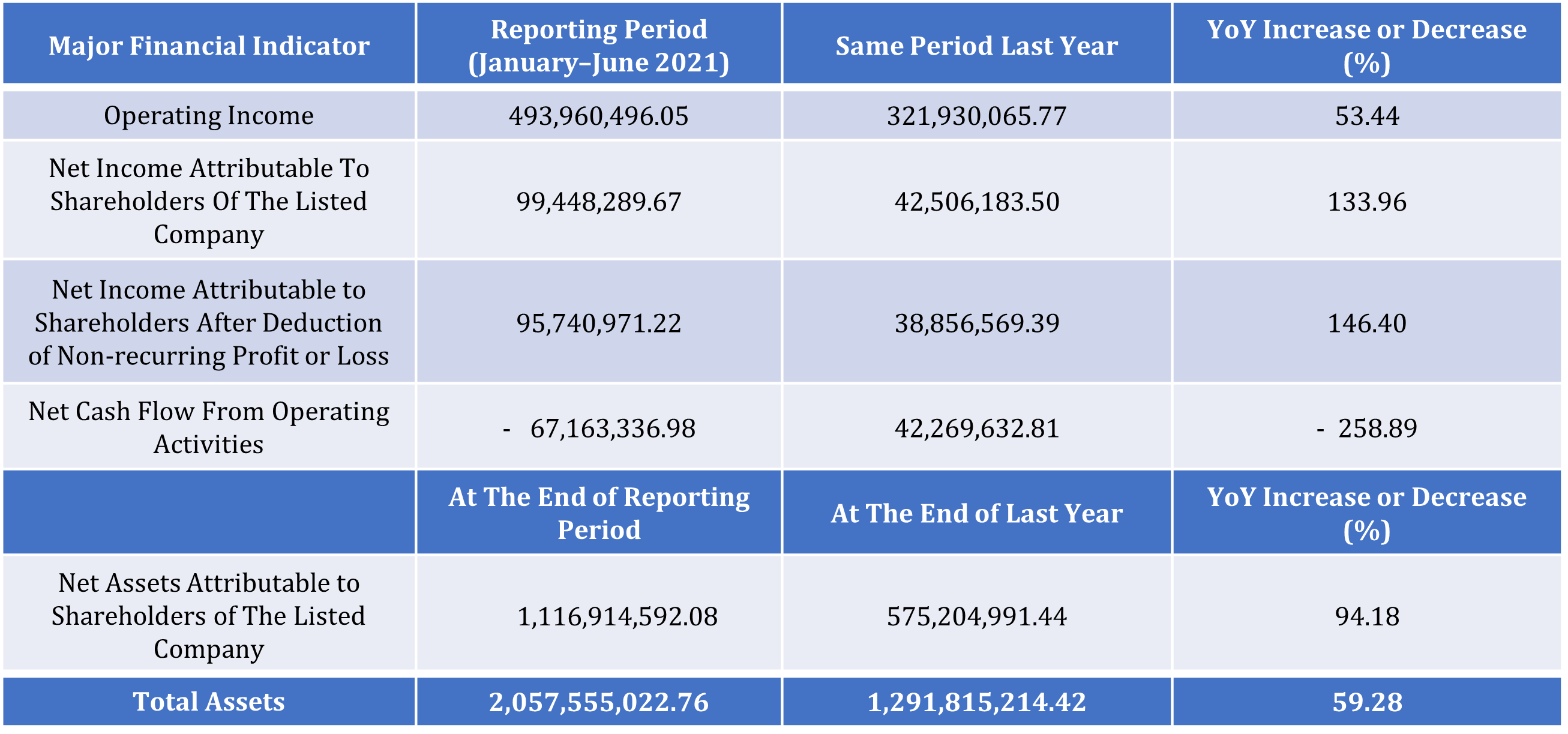

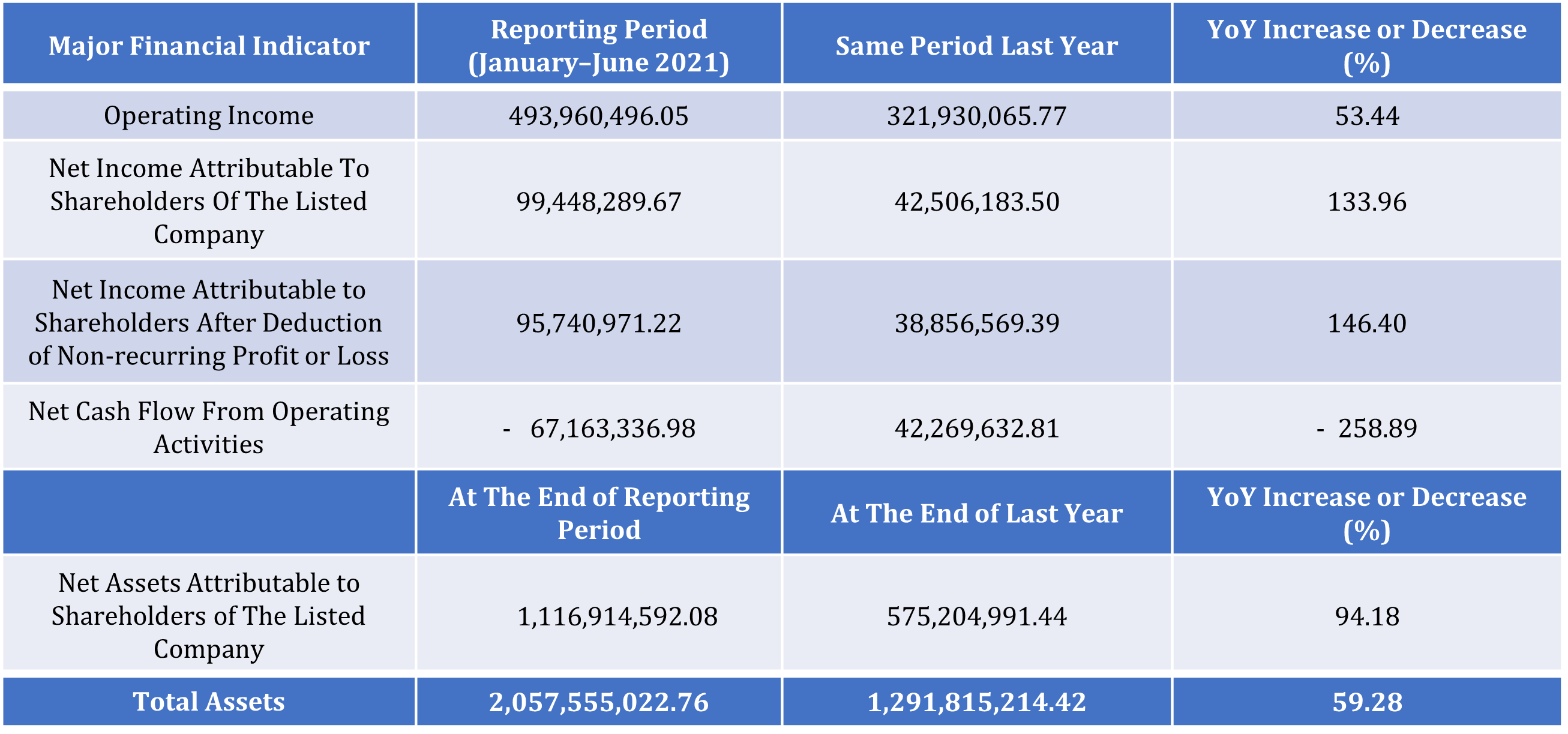

Specializing in producing smart manufacturing equipment, Xin YiChang has witnessed rapid growth following the booming development of Mini LED and semiconductor sectors. On the evening of August 15, Xin YiChang released its 1H21 earnings report, in which the company posted an operating income of RMB 494 million (USD 76.19 million; 53.44% YoY) and a net profit of RMB 99.4483 million (USD 15.33 million; 133.96% YoY).

Unit: Yuan; Currency: RMB

The LED and Semiconductor Industries Are Thriving, Boosting the Company’s Earnings

In 2021, the global consumption demand has returned, prompting the LED industry to enter a new development cycle.

In the long run, penetration rates of emerging applications such as Mini/Micro LED, UVC LED, automotive LED, and horticultural lighting will gradually increase. Specifically, the market size of Mini LED—as a next-gen display solution—is expected to rise quickly. Currently, Mini LED has become a crucial revenue source for chip, packaging, and end-use application suppliers.

According to the global LED industry database report published by TrendForce, the global LED market size will hit USD 16.53 billion with an annual increase of 8.1%. Specifically, the Mini LED and Micro LED markets constitute the second highest growth momentum with an annual growth rate of 265%.

The thriving Mini LED also contributes to Xin YiChang’s sales growth. As the said 1H21 report states, sales revenue of the company’s LED die bonders surged. Particularly, sales of Mini LED die bonders soared from RMB 21.7584 million (USD 3.36 million) in 1H20 to RMB 88.8828 million (USD 13.70 million) in 1H21.

Xin YiChang suggests that demand for computer, communication (e.g. smartphones), and consumer electronics (e.g. LCDs) has constantly increased in recent years. Meanwhile, demand in emerging markets—mainly including markets of cloud computing, big data, IoT, renewable energy, and wearables—has led to recoveries in the global semiconductor industry. China has become the largest electronics provider and consumption market, which is accompanied by enormous demand for semiconductor devices.

Under such circumstances, Xin YiChang, based on its own technologies, continued to invest in R&D and market expansion, successfully boosting the revenue of semiconductor die bonders to RMB 52.8708 million (USD 8.15 million) in 1H21, compared to RMB 3.7876 million (USD 5.84 million) the same period last year.

Both Mini LED and semiconductor die bonders have high gross margin. In a previous investor survey report, Xin YiChang mentioned that prices of Mini LED die bonders are higher than conventional bonders with greater profits. For example, the company’s conventional dual-head LED die bonder is priced at RMB 160,000 (USD 24,676) per set with a 30% gross margin. Conversely, the triple-head Mini LED die bonder is priced at RMB 1 million (USD 154,219) per set with a 60% gross margin.

The sales revenue growth in Mini LED and semiconductor bonders also fostered Xin YiChang’s gross profit margin overall. In 1H21, the company’s net income attributable to shareholders reached RMB 99.4483 million (133.96% YoY) and its net income attributable to shareholders after deduction of non-recurring profit or loss hit RMB 95.741 million (USD 14.77 million; 146.40% YoY).

Three Major Challenges Facing Mini LED Die Bonders

Mini LED is now flourishing, and the entire industry chain—from chip suppliers to packaging service and display providers—has received heavy investments. Samsung, Huawei, Xiaomi, Letv, Konka, and TCL have all launched their Mini LED end products. Epistar and Leyard established the joint venture LEADSTAR, which then partnered with Lextar to make substantial investment in the R&D and production of Mini LEDs. San’an and TCL founded a joint laboratory to develop Micro LED technologies, which then helps stimulate the industrial application of Mini LED backlights.

After shifting from conventional LED to Mini LED, the LED industry has stricter requirements of die bonders.

Efficiency is the first challenge. Mini LED signifies the LED industry’s shift to higher pixel density displays. Such development trend demands die bonders to have greater operating rate and higher accuracy so as to improve production efficiency.

The second challenge lies on yield. During Mini LED production, chip size is miniaturized with a largely increased chip number, consequently making the operation of die bonders a lot more difficult. To ensure desirable yield of Mini LED die bonders, the speed and stability of visual positioning inspection—the core feature of die bonders—must be improved. However, achieving this goal is far from easy.

The third challenge is cost. Cost reduction has always been an inevitable obstacle for an end product to enter the market. Mini LED is faced with problems of high R&D and production costs. Costs associated with chip testing and sorting are particularly huge, forcing businesses to continue seeking new techniques for cost reduction.

Image source: PAIXIN.COM

In China, Xin YiChang holds a leading position in LED die bonders and smart manufacturing equipment of capacitor aging tests. The company’s Mini LED die bonders have greater advantages over other competitors.

In late June this year, the company’s survey showed that its Mini LED tools had been mainly shipped to direct-lit display manufacturers. Reportedly, Xin YiChang’s die bonders are available for direct-lit Mini LED production at a rate of 120K pcs/hour with a high yield rate.

Xin YiChang has abundant experience in the development of backlighting technologies. It has incorporated its backlighting technologies with those of several clients, while some of the backlighting tools have been verified and put into use .

Thanks to high-quality products, technological innovations, and excellent services, Xin YiChang has established a superior customer base and good brand image, thereby being considered a top partnership candidate for well-known businesses in China and abroad.

In particular, the company’s customers in the LED industry include Nationstar, DSBJ, Shenzhen MTC, San’an, Huatian, Honglitronic, Refond, Ledman, Xindeco, and Kinglight. The company also formed close partnerships with multinational companies such as Samsung and Taiwan-based Everlight. (Written by Lynn from LEDinside)