However, company warns of demanding supply chain environment and market imbalances.

ams Osram, a developer of diverse optical solutions, has this week reported its third quarter (Q3) group financial results. “Despite continuing supply chain imbalances, our automotive business was strong while our consumer business contributed attractively in line with expectations,” commented CEO Alexander Everke.

“We continue to move ahead in re-aligning and shaping the future portfolio of ams Osram. We closed a smaller-scale disposal for building-related systems in October and are in the late stage of a larger-scale disposal. Moreover, the joint venture between Osram and Continental has been dissolved, which is another important step to streamline our business profile.

Considering market conditions, Everke said, “We see ongoing tightness in chip supply and imbalances in supply chains, particularly in the automotive market. This is introducing revenue volatility into automotive supply chains as component shortages trigger lower production volumes at automotive OEMs.

“We expect that these imbalances will persist well into the coming year and continue to be accompanied by tighter availability of certain materials and supplies. We continue to see revenue drivers in automotive and industrial lighting and consumer optical solutions in areas like display management and camera enhancement in the coming quarters.”

Third quarter group revenues were $1.52B, up 4% sequentially compared to Q2, 2021 and up 6% on Q3, 2020. Adjusted group gross margin for Q3, 2021, was 34%, up from 33% for Q2, 2021, and up from 27% for Q2, 2020. Adjusted group result from operations (pre-tax earnings) was $157M or 10% of revenues for Q3 compared with $128M or 9% for Q2, and $63M or 4% of revenues for Q2, 2020. Adjusted group net income was $12M for Q3 compared to $82M for Q2, and unchanged compared to $12M for Q2.

‘Strong semiconductors’

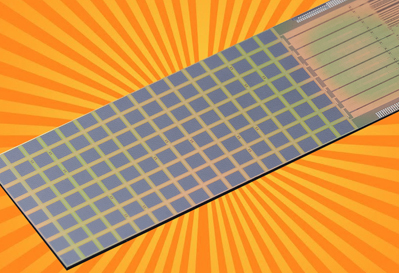

The group’s Semiconductors segment contributed strongly to group performance generating 67% of revenues in Q3, 2021, combined with a healthy adjusted operating margin of 13%. In this segment, the automotive market area recorded what ams Osram called “very positive results driven by available backlog.”

The industrial and medical sectors performed well, said the company’s financial statement, “as the attractive demand momentum in industrial lighting continues across established and emerging markets. Medical and other imaging product lines developed positively in Q3.”

The Lamps & Systems segment showed an overall positive development in Q3, contributing 33% of revenues. Market traction for

LED retrofit solutions continues to increase.

Michael Wachsler

The company stated that “it has discontinued using the advisory services of former ams CFO Michael Wachsler as ams Osram has very recently been informed of an ongoing investigation of Mr. Wachsler conducted by Austrian authorities. This is related to private securities transactions allegedly assigned to Mr. Wachsler and two former employees of ams.

“The Supervisory Board of ams AG has acknowledged Mr. Wachsler’s decision not to stand as a candidate for this Supervisory Board. Mr. Wachsler stepped down as CFO of ams effective May 2020. The company itself is not a subject of this investigation or related allegations.”

Q4 guidance

For Q4 the fourth quarter 2021, the company is expecting group revenues of $1.36B-1.46B, which excludes the disposed revenues of the DS North America and connected building applications businesses and deconsolidated revenues from the dissolved joint venture - and an expected adjusted operating margin of 8-11%.

The outlook also reflects an unfavorable exchange rate development and a decreased year-on-year contribution from the consumer market in line with previous comments and expectations. On a like-for-like revenue basis to the third quarter without deconsolidation effects, expected Q4 group revenues would be $1.41-1.51M.