LED manufacturers are branching into the niche application markets as the competition in their industry expands. Currently, entering the automotive LED market is regarded as a blue ocean strategy because the market has relatively few contestants and allows for higher pricing. According to the latest

Gold Member Report – 2016 LED Market Demand and Supply Analysis by

LEDinside, a division of

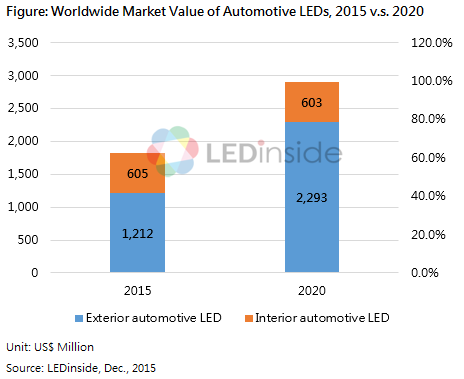

TrendForce, the worldwide market value of exterior automotive LEDs for 2015 is expected to reach US$1.21 billion. This figure is projected reach US$2.29 billion in 2020, translating to a compound annual growth rate (CAGR) of 8% during the 2015~2020 period. Additionally, the market value of standard-power LEDs is gradually declining in contrast to the rapidly rising market value of high-power LEDs. In the future, automotive LED application will take off in the high-power LED market.

Exterior automotive include directional signals, fog lights, headlights (high/low beams) and position lights. The volume of high-power LEDs used for this application has been growing each year, according to LEDinside Research Manager Duff Lu. The annual volume increases have also beaten the annual declines in high-power LED prices, thus helping to drive the market value of exterior automotive LEDs to grow at a CAGR of over 8% from 2015 through 2020. Lu added that the penetration of LED products in the exterior automotive market is currently less than 15%, so the growth potential is huge. High/low beam LEDs in particular will see the highest growth in market value, with CAGR reaching 11% during the 2015~2020 period.

Based on LEDinside’s estimates, the total LED volume used in the exterior automotive application worldwide has reached 2.79 billion pieces this year and will grow to 3.67 billion pieces in 2020. From 2015 through 2020, the LED volume used in headlights and position lights will grow by a CAGR of over 15%. During the same forecast period, high/low beam LEDs will have the highest CAGR, reaching 23%.

Interior automotive LEDs to see negative growth as applications of standard LEDs contracts

As for interior automotive LEDs, most products on the market still use standard-power LEDs. With the average sales prices of standard-power LEDs in a tailspin, the worldwide market value of interior automotive LEDs is expected to suffer negative growth in the next five years. LEDinside estimates that the market value will reach US$605 million this year but will later drop to US$603 million by 2020.

The only exception to this downtrend is LEDs for automotive instrument cluster. The market value of this application continues to grow against headwinds as the traditional mechanical instruments on the cluster are being replaced by LED instrument panels. The average size of these panels is also expanding, so more LEDs are needed. LEDinside therefore projects the CAGR of this market from 2015 through 2020 to be around 3%.

LEDinside 2016 LED Market Demand and Supply Analysis

Backlight Market Trend

Mobile Market

-

Smartphones Shipment Grows Steadily

-

Mobile LED Shipment and Market Value Outlook

-

LED Shifts From Niche to Highly Competitive Market

-

Applying Flip Chip Technology into FLASH LED

-

OLED’s Estimated Penetration Rate in Mobile Market

TV Market

-

TV Shipment Volume Sees Slow Growth

-

TV Backlight LED Shipment and Value of Production Outlook

-

CSP Flip Chip LED Penetration Rate in TV Backlight Market

-

Edge-type LED TV Road Map

-

2016 Edge-type TV LED Specifications

-

Direct-type LED TV Road Map

-

2016 Direct-type TV LED Specifications

-

Lighting LED Market Will Enter the Plateau Period During 2015 to 2020

-

Middle and Low Power LED Products’ Specifications are Tending to be Concentrated, Competitive Opportunity to Emerge

-

2835 and 3030 LEDs are the Most Competitive in Lighting LED Field

-

LED Manufacturers Introduce Higher Performance COB Products to Enhance the Added Value

-

CSP LED Solution Price Advantage is Increasingly Evident, However, Production Yields is Low in the Short Term

-

Chinese Manufacturers’ are Using Ultra-low Priced Low and Mid Power LEDs to Block CSP LED Applications in Lighting Products

-

Philips Grabs LED Lighting Market Share with Low Pricing Strategy

-

OEM LED Bulb Prices Continue to Decline

-

LED Bulb Shipment Volume Growth Increase Target of Lighting Brands is 20% to 30% in 2016

-

LED and Conventional Lighting Market Value and Volume

-

LED Lighting Replace Expectation

-

LED Lighting Industry Trends Expectation

Automotive LED Market Trend

Market Forecast

-

Exterior Automotive LED Market Value Steadily Growing

-

Exterior Automotive LED Market Volume Steadily Growing

-

Interior Automotive LED Market Value Gradually Declining

-

Automotive Panel Spurring Interior Automotive LED Volume Growth Momentum

-

Standard Power LEDs for Automotive Application Market to Shrivel up From 2015-2020

-

Automotive Lighting Product and Power Classification

Product Design

-

Automotive H/L Beam LED- High Power Market Applications

-

High-end Headlights-Adaptive Driving Beam Advancements

-

Active Headlights-ADB Control Strategy

-

Mid Class Headlights- Diversified Designs

-

Low to Mid Class Headlights-Improvements in C/P Ratio

Display Market Trend

Market Forecast

-

Benefit From Increasing Fine Pitch Display, Display LED Market Continues to Grow

-

LEDs’ Proportion in Various Cost Structure Displays

Product Design

-

Mainstream Fine Pitch Display LED Supplier and Specification

-

Fine Pitch Display LED and General Display LED Specifications

-

Fine Pitch Display Market Supply Chain Overview

-

Display Products Market Size Forecast

-

Leasing Display Market is Rapidly Rising

-

Major Manufacturers Market Share in Display Application

UV LED Market Trend

Market Forecast

-

2015-2020 UV LED Market Forecast

Product Design

UV Curing Market Application

-

Principles of UV Curing

-

UV Curing Conditions

-

Superior UV Curing Processing Factors

-

UV Wavelength Distribution and Optical Design

-

UV Irradiance vs. Radiant Energy Density

-

UV Resin and Photoinitiator

-

Thickness and Energy

-

Cooling System

-

UV Curing Machine List

-

UV Adhesive Manufacturer List

LED Supply Market Analysis

-

Analysis of Newly Installed MOCVD Worldwide

-

Analysis of LED Chip Manufacturers Utilization Rates By Global Region

-

Changes in Global LED Chip Expansion

-

Osram to Build LED Chip Plant in Malaysia, Which Could Change The Development of LED Industry

-

Potential Changes in The Industry Supply Chain Following the Completion of Lumileds’ Business Transaction to Go Scale Capital

-

Impact From China’s 13 Five-Year Plan on LED Industry

-

Global LED Wafer Production Outlook

-

Severe Imbalanced Oversupply Can Only Be Resolved By the Withdrawal of Second- Tier Manufacturers

For further information about LED industry please click here or contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912