According to the latest report by the LEDinside research division of TrendForce, 2020 Deep UV LED Application Market and Branding Strategies, the rapid acceleration of COVID-19 has generated a corresponding boom in the disease-prevention business. Case in point, the demand for UV-C LED (wavelength≦280 nm), a type of LED with disinfection/sterilization properties, has skyrocketed since the Lunar New Year, in turn causing massive shortages across the entire supply chain. Given the extreme shortage of UV-C LED chips, LED package suppliers looking to place orders for these chips need to exercise caution when setting chip specifications; these suppliers may also need to bear the risk of possible chip shortages. The current shortage in the UV-C LED market has led to an adjustment to UV-C LED chip quotes, in turn resulting in purchasers being unable to procure chips even with at high bid prices.

TrendForce Research Manager Joanne Wu indicates that some UV-C LED suppliers are already seeing order fulfillment schedules that will last till August 2020. In addition, owing to increased orders for UV-C LED, several suppliers are expected to see double-digit YoY growths in their UV-C LED revenues this year, in particular those that have maintained UV-C LED chip and package operations for many years, including Seoul Viosys, Asahi Kasei (Crystal IS), Stanley, Bioraytron (a joint venture by Epileds and HPLighting) and San’an Optoelectronics. UV-C LED chip suppliers primarily include San’an Optoelectronics, Photon Wave, Opto Tech, and Epileds.

Whereas UV-C LED suppliers have historically relied on increased efficiency and competitive prices to receive branding contracts, the coronavirus pandemic in 2020 has compelled brands and consumers alike to place a high priority on disinfection. The demand for UV-C LED has extended from China to the U.S., Europe, and Japan, culminating in peak market demand. TrendForce thus projects the UV-C LED packaging market revenue to reach 60% CAGR during 2019-2024.

In response to the increased demand for disease prevention measures, brand vendors have released a host of UV-C LED products, including disinfection bags, disinfection boxes, maternity products, UV torchlights, and portable disinfection/sterilization products. UV-C LED manufacturers have been committed to develop the field of home appliance brands for many years. As UV-C LED technology gets more mature and is more acceptable by big brands, UV-C LED will eventually enter the growth booming period in 2020. Major UV-C LED suppliers for the home appliance market include Seoul Viosys, Bioraytron, Lite-on and San’an Optoelectronics. TrendForce also expects UV-C LED to see widespread use in commercial applications such as air conditioning, surface sterilization, and water sterilization. UV-C LED suppliers for these applications include Seoul Viosys, Asahi Kasei (Crystal IS), Stanley, Violumas, San’an Optoelectronics and Nichia. In addition, the passenger car market is planning to adopt UV-C LED products as well in the form of devices for external use and disinfection modules integrated into air conditioners. All of the aforementioned applications are expected to galvanize a steady demand in the UV-C LED market.

TrendForce 2020 Deep UV LED Application Market and Branding Strategies

Release Date: 01 May 2020

Language: Traditional Chinese / English

Format: PDF

Page: 147

Chapter I. UV LED Market Scale and Application Trend

• UV Wavelength vs. Application Market Analysis

• 2020- 2024 UV LED Market Value

• 2020- 2024 UV LED Market Value- By Applications

• 2019- 2020 UV LED Market Value- By Regional Markets

• 2019- 2020 UV-A LED Market Value- By Regional Markets

• 2019- 2020 DUV LED Market Value- By Regional Markets

• 2020- 2024 UV-C LED Demand Market Volume- By Optical Power

• 2015-2020 UV-A LED Market Price Analysis

• 2015-2020 UV-C LED Market Price Analysis

• 2015-2024 UV-C LED Price Trend

• 2018-2019 UV LED Player Revenue Ranking

• 2018-2019 UV-A LED Player Revenue Ranking

• 2018-2019 UV-C LED Player Revenue Ranking

• Market Influence of The Minamata Convention on Mercury

Chapter II. UV-C Sterilization Principle

• UV-C Disinfection Principle and Applications

• Viruses and Diseases Treated With UV-C Disinfection

• COVID-19 vs. SARS

• Dose Analysis of UV-C for Major Viruses and Germs - Including SARS

• Product Features Analysis of UV-C LED and UV Mercury Lamp

• UV-C LED Sterilization Effect Key Factors

• Analysis on UV Dose Needed for Killing Major Viruses and Germs

• UV-C LED Microorganism Fatal Dose Measurement- Taking 285nm as an Example

Chapter III. UV-C LED Application Markets and Branding Strategies

• UV-C LED Application Markets and Branding Strategies- Research Scope

• UV-C LED Application Market and Optical Power Requirement Overview

3.1 Home Appliance Markets and Branding Strategies

• 2020 Surface Sterilization Application Market

• 2019-2020 Home Application Market and Branding Strategies

• 2020 Home Appliance Product Trend and Brand Vendor List

• Household Statistic Water Sterilization Market- Branding Strategies and Product Specification Analysis

• Household Air Sterilization Market- Branding Strategies and Product Specification Analysis

• Household Food Safety Market- Branding Strategies and Product Specification Analysis

• Maternity Product Market- Branding Strategies and Product Specification Analysis

• Portable Product Market- Branding Strategies and Product Specification Analysis

• UV-C’s Influence on Plastic Materials

3.2 Commercial Industry Applications and Branding Strategies

• 2020 Commercial Product Trend and Brand Vendor List

• Commercial Air Sterilization Market- Branding Strategies and Product Specification Analysis

• Commercial Surface Sterilization Market- Branding Strategies and Product Specification Analysis

3.3 Automotive Industry Applications and Branding Strategies

• 2020 Automotive Air Sterilization Market- Market Trend

Embedded Module Design and Product Analysis

External Module Design and Product Analysis

2020 Supply Chain Development and Potential Player List

2020 Supply Chain Strategic Alliance Analysis

3.4 Flowing Water Disinfection Market and Module Product Analysis

• Pros and Cons of Major Water Disinfection Methods

• UV-C LED vs. UV Lamp Purifiers Analysis

• UV-C LED Water Purifier Advantage Analysis- Product Design

• UV-C LED Water Purifier Advantage Analysis- Market Potential

• UV-C LED Water Purifier Market Key Factors

• UV-C LED Water Purifier Product Design

Reflective Materials

Optical Power Allowance

Optical, Flow Field and Heat Dissipation Design

Optical and Flow Field Coupled Design

Cost and Performance

Sterilization Rate vs. UV-C LED Optical Power Requirements

UV Dose vs. Sterilization Rate

• UV-C LED Purifier Product Analysis

Acuva Technologies

Watersprint

Nikkiso

AquiSense Technologies

Stanley

Asahi Kasei (Crystal IS)

VIEWTECH

Shui Yi Bao

QD Jason

• UV-C LED Water Purifier Comprehensive Analysis- Overview

• UV-C LED Water Purifier Comprehensive Analysis- LPM/W

• UV-C LED Water Purifier Comprehensive Analysis- LPM/USD

• Flowing Water Sterilization Market- 2020 Development Trend and Potential Player List

3.5 NSF/ANSI 55-2019 Standard Analysis

• NSF/ANSI 55-2019 Standard Introduction

• NSF/ANSI 55-2019- Newly Increased Contents Description

• NSF/ANSI 55-2019 vs. GB2835-2020 Analysis

• Impact of NSF/ANSI 55-2019 on UV LED Water Purifier Product Design

• Self-Test Method Before NSF/ANSI 55-2019 Verification

Chapter IV. Specialty Lighting Market Trend and Practical Case Studies

• Research Scope

• General Lighting vs. UV Lamp Players List

• Sterilization Lighting Market- Practical Case Study

• Food Industry Market- Theoretical / Experimental Data

• Food Industry Market- Practical Case Study

• Fishery Harvesting and Aquatic Product Preservation Markets- Practical Case Study

• Horticultural Lighting Market- Theoretical / Experimental Data

• Horticultural Lighting Market- Practical Case Study

• Phototherapy Market Trend- Practical Case Study

• Curing Equipment Market- Practical Case Study

Chapter V. UV LED Player Revenue and Business Strategy Analysis

• 2018-2019 UV LED Player Revenue Ranking

• UV-A LED Major Players List

• 2018-2019 UV-A LED Player Revenue Ranking

• UV-C LED Major Players List

• 2018-2019 UV-C LED Player Revenue Ranking

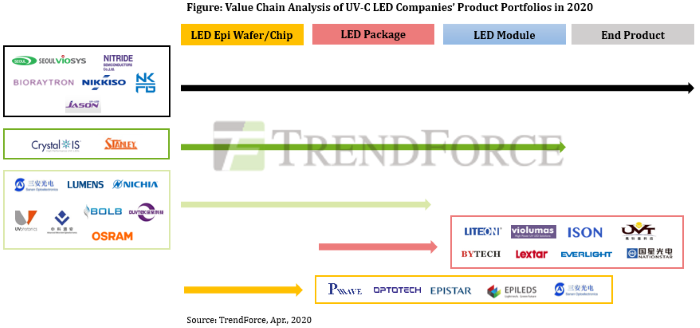

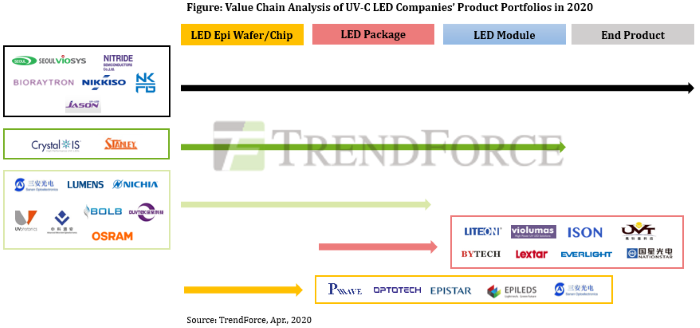

• 2020 UV-C LED Player Product Value Chain Analysis

• UV-C LED Wavelength vs. Optical Power Analysis

• UV-C LED Wavelength vs. External Quantum Efficiency (EQE) Analysis

• UV-C LED Wavelength- Optical Power- EQE Analysis

• 22 UV LED Players Revenue and Business Strategy Analysis

Chapter VI. UV-C LED Technology and Patent Analysis

• UV-C LED Technical Threshold Analysis

• UV-C LED Technology Analysis- Epitaxy

• UV-C LED Technology Analysis- Chip

• UV-C LED Technology Analysis- Major Chip Technology Analysis

• UV-C LED Technology Analysis- 2020 Package Technology Analysis

• 2016-2019 UV LED Patent Litigation

• Nitride Semiconductors UV LED Patent

• LG Innotek UV LED Patent

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|