According to the latest investigations by TrendForce, despite the slight slowdown in wearables shipment (including smartwatches and smart wristbands), the increasing demand for improved health monitoring functions has galvanized a strong momentum in the market for wearables-related components. For instance, to raise the accuracy of health monitoring functions, wearables manufacturers are projected to utilize more green LEDs and infrared LEDs while also increasing the size of photodiodes, in turn doubling the demand for PPG.

TrendForce indicates that most wearables measure biometric data, such as heart rate, blood oxygen, blood pressure, and blood sugar levels, as well as sweat content, through a type of optical technology known as photoplethysmography (PPG). PPG design consists of a transmitting end and a receiving end. PPG transmitters measure heart rate via detecting the amount of blood flowing through the user’s wrist for a given duration, generally by using green LEDs paired with infrared LEDs. On the other hand, pairing infrared LEDs with red LEDs will allow these transmitters to obtain blood oxygen levels by measuring the difference between oxygenated and deoxygenated hemoglobin for a given duration.

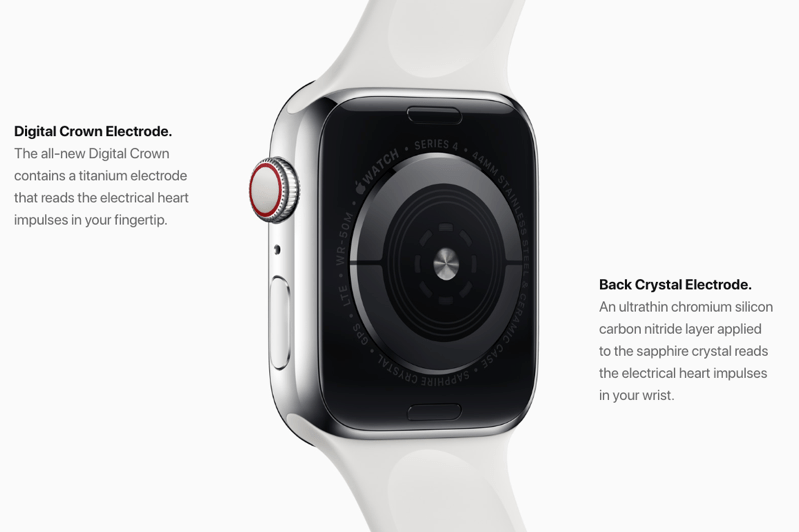

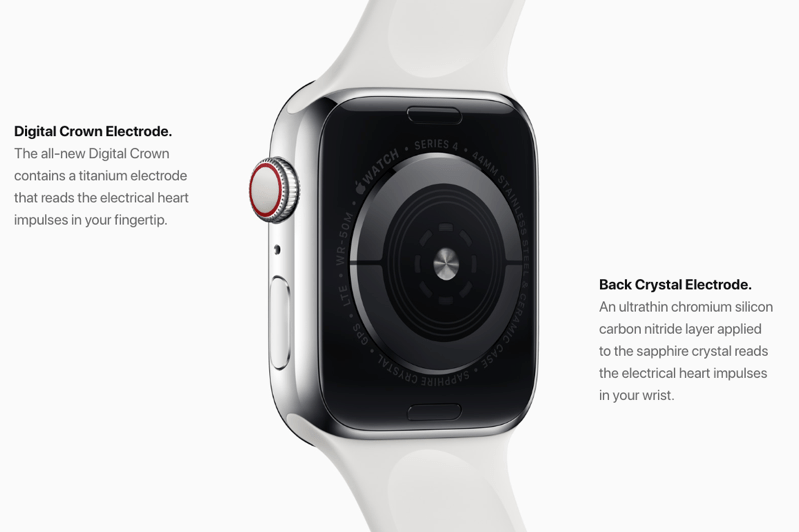

Most PPG receivers are designed to feature low dark current photodiodes, which provide fast response times and are capable of receiving the total energy emitted from the LED. Apple Watch 4, for example, contains four to five times as many photodiodes as does Apple Watch 3.

(Image: Apple)

TrendForce projects PPG revenue to grow from US$38.1 million in 2019 to $63.33 million in 2020, a 66.2% increase YoY. PPG product design is expected to shift from a discrete optical sensor design to a modular one, allowing suppliers to deliver optical components with fewer manufacturing errors and greater ease of integration to wearables brands. Major companies in the PPG supply chain include OSRAM Opto Semiconductors, Lite-on, DOWA, Epistar, Epileds, and Opto Tech.

Owing to the influence of the COVID-19 pandemic, medical and healthcare-related applications are likely to see increasing priority in terms of product development going forward. As well, given that wearables are equipped with health monitoring functions, wearables manufacturers will aim to improve their products’ biometric functions such as accuracy. Fitbit, for instance, has integrated blood oxygen monitors into several of its products. The company is currently collaborating with several academic institutions to develop health screening functions capable of detecting diseases in their early stages. On the other hand, Samsung has announced blood pressure monitoring applications for its smartwatches. Aside from these two companies, major wearables brands are also actively targeting blood pressure and blood sugar monitoring as potential features in their lineups. These features are expected to become key upgrades for the next generation of wearable devices.

2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System

Release: 01 January 2020

Language: Traditional Chinese / English

Format: PDF

Page: 153 pages

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|