According to the latest report by LEDinside, the research division of TrendForce, “2020 Global Automotive LED Product Trend and Regional Market Analysis,” automotive LED market demand steadily increase by advanced technologies, such as intelligent headlamp, central tunnel taillights, HDR automotive display, ambient light, etc. TrendForce analyze automotive LED market development by five directions, including automotive lighting and display product trend, automotive lamp player revenue and development strategies, LED player revenue performance and product price, in order to provide readers with a comprehensive understanding of automotive LED market trend.

Automotive Lighting Product Trend

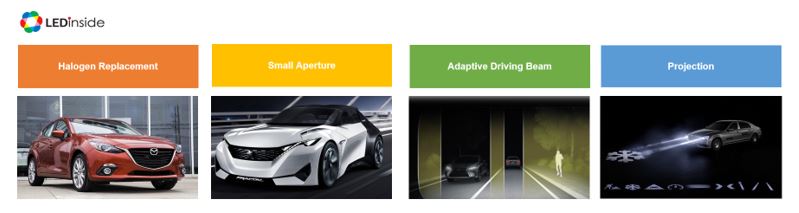

Headlamp development includes four main trends, for instance, halogen replacement, small aperture, adaptive driving beam and projection. According to LEDinside, halogen replacement and ADB will occupy 70-90 percent of headlamps’ market share in the next five years.

ADB is an automotive lighting system that can automatically adjust the beam of light so as to ensure the lamp can lighten the front view while protecting the oncoming cars or the vehicles ahead from being affected by glare and cause traffic accident. For the suppliers of auto lamps, ADB can increase the value of auto lamps and directly become an upgraded alternative for halogen lamp. Thereby, ADB will be a key project to develop in the future.

Micro LED is one of several ADB headlamp solutions, which owns many advantages. For instance, lower system cost, smaller system volume and considerably high efficiency. Micro LED Pixel Array is confined to the number of pixel. By far, pixel number of Micro LED Pixel Array unveiled is at a thousand level, which is expected to increase to ten-thousand in the next few years while pixel number higher than a hundred thousand is planned in the longer term. Major players include Koito, Valeo, Hella, OSRAM, Nichia, Samsung LED, CREE, Stanley, etc.

Automotive Display Product Trend

1. HDR Display: Since 2020, car makers attempt to implement HDR and local dimming technologies to enable the automotive display to provide higher brightness and better contrast ratio. Unlike consumer electronics, automotive display requires less rigorously on thickness, so it needs a fewer number of LEDs. Considering yield, many makers also adopt LED package or Mini LED matched with drive IC to achieve HDR local dimming display. Given the demand for local dimming and cost requirements, mainstream local dimming will have 60-384 dimming zones. Major players include GM, Innolux, AUO, Macroblock, Nichia, OSRAM, Everlight and Lextar.

2. Full Car Display: Limited by automotive safety regulations (Ensure no glass fragments when the airbag inflates.), auto makers currently can only use OLED display if they want to extend automotive panel from cluster to CID and co-pilot seat (A pillar-left to A pillar-right).

3. Transparent Display: Micro LED, the next-generation display technology, can be equipped with flexible display and transparent display to be used in smart vehicle in the future, and the information display will appear in almost everywhere in the car. Micro LED display will create a new era of mobility and communication for ADAS, autonomous vehicle and car sharing.

Automotive Lamp Market Scale and Player Strategies

According to LEDinside’s investigation and analysis, due to the China-US trade conflicts, the market size of global auto lamp reached USD 29.212 billion (-8% YoY) in 2019. Top five international auto lamp manufacturers included Koito, Valeo, Automotive Lighting, Hella and Stanley respectively. Most manufacturers’ revenue for 2019 declined 6%-12% but thanks to the optimization of product mix, Xingyu enjoyed an annual growth up to 25.55%. In addition, as the upgrading of intelligent driving brings about the opportunity of updating LED headlamp and ADB, the value of a single auto lamp increases year by year. In this context, Xingyu has successively received orders from well-known brands such as BMW, Audi and Jaguar Land Rover.

Automotive LED Player Revenue Performance

According to LEDinside estimates, automotive LED market scales in 2019 reached USD 2.672 billion. Most automotive LED suppliers posted a YoY decline of 15-30% in revenue for 2019 because of the impact of the US-China trade conflict on new car sales and the fierce price competition. In addition, OSRAM’s automotive LED market share fell to 34% in 2019, whereas Nichia’s market share crept up just a bit to 25% in 2019.

Impact of COVID-19 on Automotive Market

Amid the China-US trade conflicts and the COVID-19 crisis, the supply chain and cash flow are likely to face disruption and vendors fail to make delivery and payment, which might present a potential risk to the market and lead to a reshuffle for the supply chain. In addition, in a bid to more precisely control manufacturing quality, cost and product performance, both car makers and auto lamp players actively master the information of important components.

Author: Joanne, Research Manager at TrendForce

TrendForce 2020 Global Automotive LED Product Trend and Regional Market Analysis

Release Date: 30 June 2020 (PDF);30 June 2020 and 31 December 2020 (EXCEL)

Language: Traditional Chinese / English

[PDF Content]

Chapter I. Automotive Lighting Market Trend Analysis

• Headlamp Product Trend

• Headlamp Product Technology Requirement

• AFS vs. ADB Product Analysis

• Intelligent Headlamp Product Trend

LED Matrix vs. LCD Intelligent Lamp

DMD Technology

Micro LED Pixel Array Manufacturing

Micro LED Pixel Array Market Landscape

Micro LED Pixel Array Market Value

• Intelligent Headlamp Characteristics and Comprehensive Analysis

• Laser Headlamp Product Trend

• Pros and Cons of the Integration of LiDAR and Headlamp

• RCL Product Trend

• OLED-Like LED Surface Light RCL Product Trend

• Mini LED RCL Pros and Cons Analysis

• Ambient Light Product Trend vs. Pros and Cons Analysis

• Mini LED vs. Micro LED Automotive Lighting Planning Overview

Chapter II. Automotive Display Market Trend Analysis

• 2020 Four Automotive Display Product Trends

• 2020 Automotive Display Product Trend- By Application

• Automotive Display LED Product Specification and Value Chain Analysis

• 2020 HDR vs. Local Dimming Trend and Supply Chain Analysis

• 2020 Edge-Type vs. Direct-Type (HDR / Local Dimming)

Automotive Display Cost Analysis- Case Study

• 2020-2025 Mini LED Automotive Display Shipment Analysis

• Micro LED vs. OLED Full Car Display Product Trend

• Micro LED Automotive Transparent Display Trend

• 2020 Micro LED Automotive Transparent Display Cost Analysis

• HUD Product Trend and Major Player Market Share Analysis

• E-Mirror Product Trend

• 2020 Driver Monitoring System / Occupancy Monitoring System

Market Trend

• 2020 Automotive Air Sterilization Market Trend

Chapter III. Global Automotive Lamp Player Revenue and Movements

• Major Auto Lamp, Module, LED Value Chain Analysis

• 2017-2019 Global Top 13 Auto Lamp Player Revenue Ranking

• 2017-2019 Global Auto Lamp Player Market Share

• Automotive Lamp Player Revenue and Product Strategies

• Koito Manufacturing Co., Ltd.

• Valeo

• Marelli Holdings vs. Automotive Lighting

• Hella

• Stanley

• HASCO Vision

• ZKW Group

• Varroc Lighting Systems

• Xingyu

• SL Corporation

• Mande

• Nanning Liaowang

• Tong Ming

• Automotive Lamp vs. Module Factories in China

Chapter IV. Global Automotive LED Player Revenue and Strategies

• 2018-2019 Global Top 15 Automotive LED Player Revenue Ranking

• 2019 Automotive LED Player Market Share Analysis

• Automotive LED Player Revenue and Product Strategies

• OSRAM

• Nichia

• Lumileds

• Stanley

• Seoul Semiconductor

• Dominant

• Samsung Electronics

• Everlight

• CREE

• Hongli

• Jufei

• LatticePower

• Sunpu

• Refond

Chapter V. The Impact of COVID-19 on Global Automotive Industry

• 2019-2020 Global Passenger and Box Truck Market Shipment

• The Impact of COVID-19 on Global Auto Manufacturing

• COVID-19 Analysis of the Impact on China’s Automobile Manufacturing and Consumption Policy by Province

• 2020 Automotive Lighting Market Trend and Supply Chain Trend

[EXCEL Content]

PART One. 2019-2020 Car Market Shipment Forecast- By Region

• Europe

• USA

• Japan

• China

• Emerging Market (India, Brazil, Southeast Asia)

PART Two. 2020-2024 Automotive LED Market Value, Volume and Penetration- By Product

• Conventional Passenger Car (OE)

• Conventional Passenger Car (AM/PM)

• Electric Passenger Car (OE)

• Electric Passenger Car (AM/PM)

• Conventional Box Truck (OE)

• Conventional Box Truck (AM/PM)

• Electric Box Truck (OE)

• Electric Box Truck (AM/PM) "

Automotive Exterior

• RCL

• DRL

• Position / Signature

• High / Low Beam

• Fog / Side Marker

• Direction

• CHMSL

• Mirror Lamp

Automotive Interior

• Cluster

• Reading Lights

• CID (AC, DVD)

• Panel (GPS, Entertainment)

• Others (Decoration, etc.)

PART Three. 2019-2020 Automotive LED Market Value, Volume and Penetration- By Product

Regional Markets

• Europe

• USA

• Japan

• China

• Emerging Market (India, Brazil, Southeast Asia)

Products

Automotive Exterior

• RCL

• DRL

• Position / Signature

• High / Low Beam

• Fog / Side Marker

• Direction

• CHMSL

• Mirror Lamp

Automotive Interior

• Cluster

• Reading Lights

• CID (AC, DVD)

• Panel (GPS, Entertainment)

• Others (Decoration, etc.)

PART Four. Automotive Lamp vs. Automotive LED Revenue Performance

• 2017-2019 Automotive Lamp Player Revenue Ranking

• 2017-2019 Automotive LED Player Revenue Ranking

• 2019 Automotive LED Player Revenue Ranking- Exterior: Interior

• 2019 Automotive LED Player Revenue Ranking- APAC : USA : EMEA

• 2020 Automotive Lamp Price Survey

• 2018-3Q20 Automotive LED Price Trend- Headlamp, RCL, Automotive Display

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|