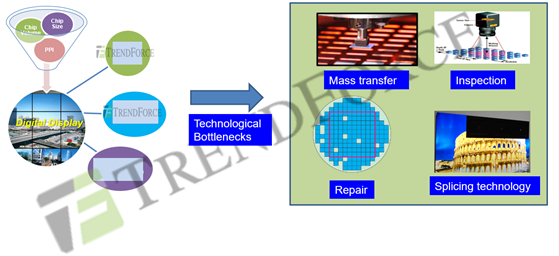

Currently, there are still several technological bottlenecks that need to be overcome in the development of Micro LED products. Most companies that are participating in the Micro LED supply chain have yet to progress beyond R&D and the setup of a production line. To determine whether a Micro LED product is ready for commercialization, we not only have to look at the latest technological advances but also analyze to see if the yield rate of the whole fabrication process is high enough to obtain the optimal production cost and thereby enable commercialization. Technology, product quality, production cost, and market demand will all have to converge at the sweet spot in order for Micro LED to have a chance to become the next mainstream display technology.

TrendForce in its research has found that Micro LED made headway into large-sized displays earlier than it did for other display applications. Hence large-sized Micro LED displays are more mature than small- and medium-sized Micro LED displays in terms of technology and cost. Also, South Korean electronics brands are keen on using Micro LED to build TVs that can offer the best performance. TrendForce forecasts that the global market value of Micro LED chips for TV displays will reach US$3.4 billion in 2025. As for the market for large-sized self-emissive Mini LED displays, it is being driven by the reduction in pixel pitch for large-sized indoor LED displays and the gradual rise in the demand for HD video walls from commercial venues such as conference halls, retail stores, etc. TrendForce forecasts that the global market value of Mini LED chips for (self-emissive) display applications will reach US$480 million in 2025.

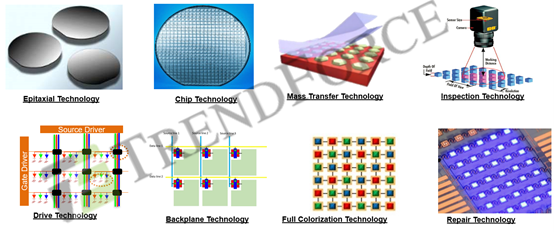

According to the analysis of TrendForce, a meticulous manufacturing process is required for Micro LED, and the specification and precision is relatively rigorous for the raw materials, consumables, production equipment, testing instruments, and auxiliary jigs used in the process. New Micro LED display currently faces technical bottlenecks such as epitaxy, chips, transfer, full colorization, power drive, backplane, as well as inspection and repair technology. The current bottlenecks of Micro LED epitaxial technology include wavelength uniformity, control on defects and suspended particles, and an effective utilization of epitaxial wafer dimension, whereas bottlenecks of Micro LED chips lie on the low luminous efficacy for red light, the reduction of luminous efficacy due to electric leakage, production of the structural weakening process, and the protection on the insulating layer of chips. The bottleneck of mass transfer technology comes from the fact that products with different specifications prompt for varied mass transfer technology, and there are differentiation in equipment precision, process yield rate, process capacity, as well as the cost of equipment and process for each mass transfer technology, whereas the rapid inspection and repair of transferred Micro LED chips is also the key to the cost of processes.

In terms of backplane and driver, silicon substrate is suited for small and high resolution displays, though an adoption on full color displays would impose technological and cost challenges right now. Although glass substrates are the forte of panel manufacturers, there is a big difference between the constant current drivers of Micro LED and the drivers of TFT, thus Micro IC is a critical component for constant current. The commercialization of PCB is relatively fast, and previous passive driver solutions may be used, where large displays can be created by splicing multiple substrates. However, due to the trace width/spacing limitations of PCB and the demanding flatness specification for solder joints, large display designs with a dot pitch of below P0.4 will create a prominent challenge for PCB manufacturers.

The analysis of TrendForce indicates that the current development of large self-emitting Mini/Micro LED display products faces relatively large technological challenges in mass transfer, inspection, and repair technology, which although are overcome by many suppliers using the splicing method, it creates an exorbitant production cost nonetheless. South Korean suppliers had started the relevant arrangement in advance, and Mini/Micro LED self-emitting displays are mainly offered by Taiwanese and Chinese suppliers in the current phase. Owing to the higher degree of technology in Micro LED, the product will be primarily offered by Taiwanese suppliers, who excel better in technological level and the stability in mass production, in the future.

TrendForce had implemented an analysis on the tendency and supplier strategies on self-emitting Mini/Micro LED displays in April 2021. Please call or email us if you require further information on the particular topic, thank you.

TrendForce 2021 Mini / Micro LED Self-Emissive Display Trends and Analysis on Suppliers’ Strategies

Release Date: 30 April 2021

Language: Traditional Chinese / English

Format: PDF

Chapter 1. Analysis on the Scales of the Markets for Self-Emissive Display Mini / Micro LED Displays

- Definitions and Sizes of Mini / Micro LED Chips

- 2020-2025 Mini / Micro LED Output Value Analysis and Forecast

- 2020-2025 Mini / Micro LED Output Analysis and Forecast

- 2020-2025 Mini / Micro LED Display Penetration Forecast

Chapter 2. 2021 Overview of Critical Technology in Mini / Micro LED Self-Emissive Display

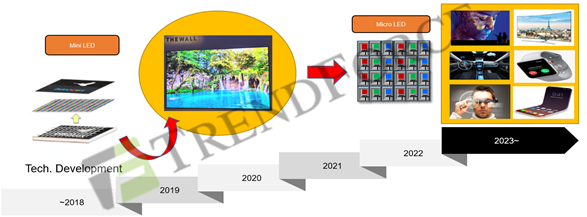

- Development Trends in New Display Technology

- Comparison in Competitiveness between New Display Technologies

- Development Progress of Mini / Micro LED Self- Emissive Display

- Features of Mini / Micro LED Self- Emissive Display Products

- Comparison between Mini / Micro LED Luminous Sources in Displays

- Manufacturing Process of Micro LED Display

- Bottlenecks in Critical Technology for Micro LED

- Key to the Epitaxial Technology of Micro LED

- Analysis on the Bottlenecks of Micro LED Epitaxial technology

- Micro LED Epitaxial Technology Bottlenecks – Wavelength Uniformity

- Micro LED Epitaxial Technology Bottlenecks – Epitaxial Defect Control

- Micro LED Epitaxial Technology Bottlenecks – Effective Utilization of Epitaxial Wafers

- Analysis of Micro LED Epitaxial Technology

- Key Technologies of Micro LED Chip Manufacturing

- Technological Bottlenecks in the Development Micro LED Chips

- Bottleneck: Materials for Light-Emitting Epitaxial Layers and Luminous Efficacy of Red Light

- Bottleneck: Chip Shrinking Causes Electric Leakage and Lowers Luminous Efficacy

- Bottleneck: Structural Weakening and Insulation Layer

- Analysis on the Applications of the Technologies Related to Micro LED Chips

- Development of Mass Transfer and Bonding Technologies

- Keys in Mass Transfer and Bonding Technology for Micro LED

- Overview on the Mass Transfer Technology for Micro LED

- Pick and Place Technology for Mass Transfer of Micro LED

- Laser Transfer Technology for Mass Transfer of Micro LED

- Fluidic Assembly Transfer Technology for Mass Transfer of Micro LED

- Roll Transfer Technology for Mass Transfer of Micro LED

- Wafer Bonding Technology for Mass Transfer of Micro LED

- Magnetic Mass Transfer Technology for Mass Transfer of Micro LED

- Analysis on the Bottlenecks of Mass Transfer Technology for Micro LED

- Analysis on the Applications of Mass Transfer Technology for Micro LED

- Overview on the Inspection Technology of Micro LED

- Overview on the Repair Technology of Micro LED

- Overview on the Bonding Materials of Micro LED

- Analysis on the Application of the Bonding Technology for Micro LED

- Overview on the Full Color Technology of Micro LED

- Micro LED Full Color Technology Comparison

- Micro LED Full Color Technology Application Analysis

- Bottlenecks in Micro LED Driver and Backplane Technology

- Micro LED Backplane technology application analysis

Chapter 3. Current Development of Mini / Micro LED Self-Emissive Display Applications

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Displays- Major Taiwanese Manufacturers

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Displays- Major Chinese Manufacturers

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Displays- Major Korean Manufacturers

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Displays- Major Japanese Manufacturers

- Current Development of Mini / Micro LED Self-Emissive Displays - Large Displays- Major European and American Manufacturers

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Display Specifications-1

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Display Specifications-2

- Current Development of Mini / Micro LED Self-Emissive Displays- Large Display Specifications-3

- Current Development of Micro LED Self-Emissive Displays- Car Displays and Transparent Displays- Major Taiwanese Manufacturers

- Current Development of Micro LED Self-Emissive Displays- Car Displays and Transparent Displays- Major Chinese Manufacturers

- Current Development of Micro LED Self-Emissive Displays- Car Displays and Transparent Displays

- Micro LED Self-Emissive Display's Current Development Status – Watches & Wearables

- Micro LED Self-Emissive Display's Current Development Status - Augmented Reality Applications

Chapter 4. Micro LED Self-Emissive Display – Large Display Products

- Viewing Distance and Pixel Connectivity

- Developments of Mini / Micro LED in Market for Large-Sized Displays

- Projection on Shipments of Large-Sized Mini / Micro LED Displays

- Cost Trends of Large-Sized Mini / Micro LED Displays

- Cost Analysis for Large-Sized Mini / Micro LED Displays

- Technological Bottlenecks for Large-Sized Mini / Micro LED Displays

Chapter 5. Self-Emissive Micro LED Displays for TVs

- Development Trend of Micro LED in TV Market

- Features of Micro LED TVs

- Micro LED TVs – Shipments and Competitiveness

- Cost Trend of Micro LED TVs

- Cost Analysis of Micro LED Displays for TVs

- Technology Bottleneck Analysis of Micro LED Displays for TVs

Chapter 6. Self-Emissive Micro LED Displays – For IT Devices

- Development Trends in Micro LED Displays for IT Applications

- Shipment and Competitiveness Analysis of Micro LED Displays for IT Devices

- Long-term Cost Forecast of Micro LED Displays for IT Devices

- Cost Analysis of Micro LED Displays for IT Devices

- Technology Bottleneck Analysis of Micro LED Displays for IT Devices

Chapter 7. Self-Emissive Micro LED Displays for Automotive Applications

- Development Trends in Micro LED Displays for HUDs

- Shipment and Competitiveness Analysis of Micro LED Displays for Automotive Applications

- Cost Trends in Micro LED Displays for Automotive Applications

- Cost Analysis of Micro LED Displays for Automotive Applications

- Technology Bottleneck Analysis of Micro LED Displays for Automotive Applications

Chapter 8. Self-Emissive Mini / Micro LED Displays for Smartphones

- Development Trends in Micro LED Displays for Smartphones

- Shipment and Competitiveness Analysis of Micro LED Displays for Smartphones

- Cost Trends in Micro LED Displays for Smartphones

- Cost Analysis of Micro LED Displays for Smartphones

- Technology Bottleneck Analysis of Micro LED Displays for Smartphones

Chapter 9. Self-Emissive Mini/ Micro LED Displays for Wearable Devices

- Development Trends in Micro LED Displays for Smartwatches

- Shipment and Competitiveness Analysis of Micro LED Displays for Wearable Devices

- Cost Trends in Micro LED Displays for Smartwatches

- Cost Analysis of Micro LED Displays for Smartwatches

- Technology Bottleneck Analysis of Micro LED Displays for Smartwatches

Chapter 10. Self-Emissive Mini/ Micro LED Displays for Head-mounted Devices

- Development Trends in Micro LED Displays for AR Devices

- Shipment and Competitiveness Analysis of Micro LED Displays for Head-mount Devices

- Cost Trends for Micro LED Displays for AR Devices

- Cost Analysis of Micro LED Displays for AR Devices

- Technology Bottleneck Analysis of Micro LED Displays for AR Devices

Chapter 11. Self-Emissive Mini/ Micro LED Displays – Key Brands’ Development

- Large-sized Micro LED Display Supply Chain - Samsung

- Large-sized Micro LED Display Supply Chain - LG

- Large-sized Micro LED Display Supply Chain - SONY

- Large-sized Micro LED Display Supply Chain – Konka

- Large-sized Micro LED Display Supply Chain - Leyard

- Large-sized Micro LED Display Supply Chain - TCL